Deciding Upon Tactics In Get Out Of Debt Fast

Not known Incorrect Statements About Get Out Of Debt

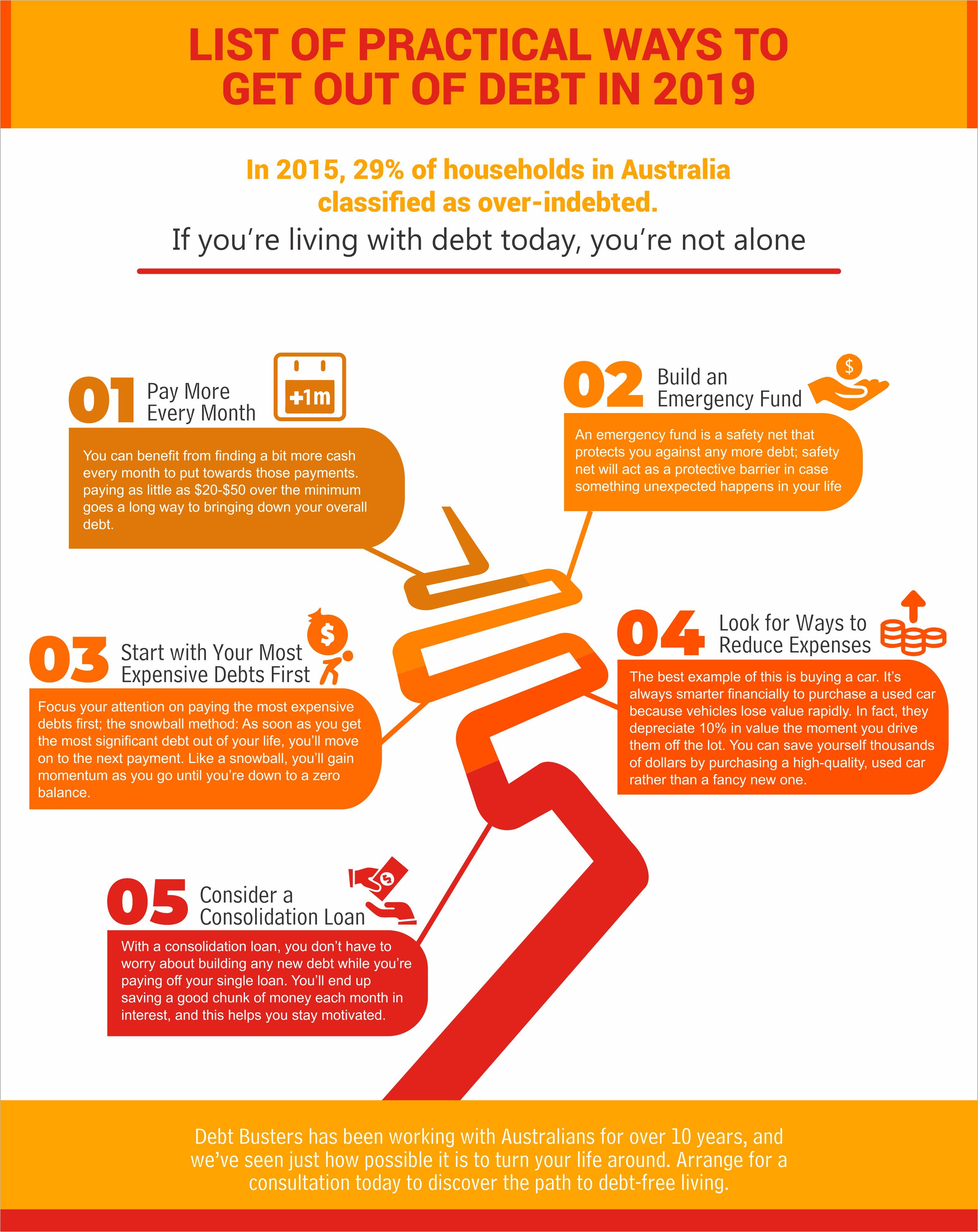

Once you know how much you owe, the next action in discovering how to get out of debt is ... Once you understand exactly how much you owe, you're all set to tactically attack your debt. To do this, you require to prioritize which of your debts you're going to settle initially-- whether it be your charge card, student loans, whatever-- based upon the interest rate.

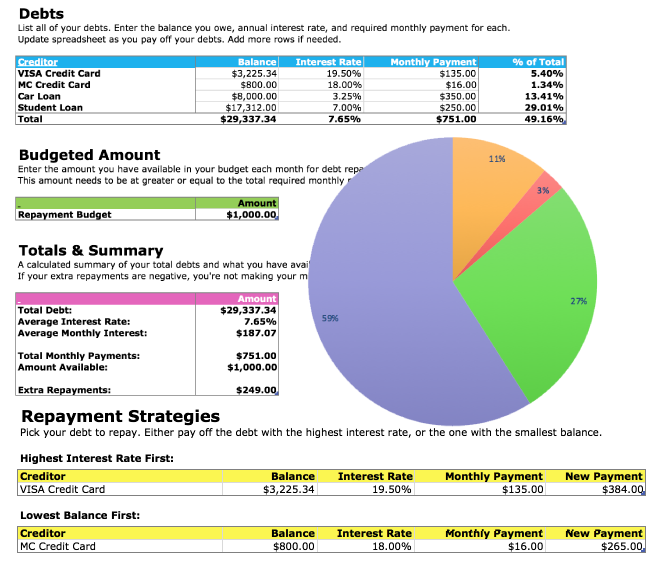

For example, let's say Credit Card A has a balance of $1,000 and a 12% rate of interest, and Credit Card B has $1,500 at 6% interest. You put down $150 overall on a monthly basis, paying the minimum payment (3%) on one and whatever's left on the other. You're going to conserve more cash by removing Credit Card A first ($ 147 in total interest) vs Card B ($ 188).

When it http://bettydriscollcorbin35rt.nikehyperchasesp.com/a-background-analysis-of-programs-of-financial-debt-solutions concerns your student loans , you can really save countless dollars each year-- by paying down your debt more each month. Yes, you check out that right. You can save money by spending MORE. Let's state you have a $10,000 student loan, at a 6.8% rate of interest, and a 10-year payment duration.

But inspect out just how much you can save per year if you paid simply $100 more every month: Like I stated previously, paying the minimum digs you into a larger hole. Even $20 more each month can conserve you huge amounts of money. I've using this calculator . Additionally, you can utilize the "debt snowball" technique, which I discuss here (at around 2:00).

That's why you require to do the following things: Secure your wallet. Dispose out all your credit cards. Mail them all to Antarctica. Well, maybe you don't have to be that severe ... however the point is to get rid of all temptation of ever using your credit cards once again until you run out debt.

Excitement About Get Out Of Debt Fast

Seriously. Once you actually freeze your credit , you'll have to chip away at an enormous block of ice in order to get it back-- offering you time to consider whether or not you wish to go through with whatever purchase you were going to make. Alternatively, you can lock them in a safe or have a buddy/ moms and dad/ sibling/ whoever-you-trust hang on to them for you.

Not many individuals recognize this, but you can actually conserve over $1,000 in interest with a single five-minute call. Through simple negotiations, you can decrease the APR on your credit card and put thousands of dollars back into your pocket. I ENJOY working out rates of interest. It can be insane easy too-- in truth, here's a word-for-word script that a lot of my readers have used already to decrease their rates of interest: YOU: "Hi, I'm going to be settling my credit card debt more aggressively starting next week, and I 'd like to decrease my charge card's interest rate." CC REPRESENTATIVE: "Uh, why?" YOU: "I have actually chosen to be more aggressive about settling my debt, and that's why I wish to reduce the rates of interest I'm paying.

Can you decrease my rate by 50% or only 40%?" CC REP: "Hmmm ... After evaluating your account, I hesitate we can't provide you a lower interest rate." YOU: "As I mentioned before, other credit cards are using me absolutely no percent introductory rates for 12 months, along with APRs that are half what you're offering.

Can you match the other credit card rates, or can you a minimum of go any lower?" CC ASSOCIATE: "I see ... Hmm, let me pull something up here. Fortunately, the system is suddenly letting me offer you a decreased APR. That works immediately." It's really that simple to save money in 5 minutes.

Make certain to adjust your debt chart from step one. You get to slice that big ugly rate of interest down and reduce your monthly payments. Repeat this procedure for any other cards you can, and after that move on to my preferred action. If you find that no matter how you run the number you're not going to have the ability to pay your trainee loans off in any reasonable quantity of time, it's time to call your loan provider.

The Buzz on Get Out Of Debt Fast

Call them up and request for their advice. Seriously, I can't emphasize this enough. Your lenders have heard all of it, from "I can't pay this month" to "I have 5 various loans and wish to consolidate them." For your purposes, ask the following: "What would happen if I paid $100 more each month?" (Replace any number that's right for you.) "What would take place if I changed the timeline of the loan from 5 years to 15 years?" If you're looking for a task, you might ask, "What if I'm trying to find a task and can't afford to pay for the next 3 months?" Your loan provider has responses to all these questions-- and opportunities are they can assist you discover a much better method to structure your payment.

Just think: With that one call you might save countless dollars. If you've followed along this far, you're most likely thinking, "This is fantastic and all, however where do I get the cash to pay for all these bills?" I recommend 4 http://edition.cnn.com/search/?text=debt solutions things: Utilize the money you have actually freed up from Step 4 Use cash you have from your invests over $21,000 a year on going out ) Use Hidden Earnings Make more money I've currently discussed how to get cash from reducing your interest rates and you can discover more about creating a Conscious Budget here .

Instead of rigorous budget plans or severe frugality, I choose to cut expenses mercilessly on everyday bills. These are things like your cellular phone, car insurance, and other month-to-month expenses. Conserving money on these daily products is an easy way to maximize cash to put towards your debt. The cool thing is, we can show you how to conserve $1,000-- without cutting down on the things you like-- like these people did: Simply have a look at my Conserve $1,000 in a Month Challenge here .

I have actually always thought that there's a limit to just how much you can conserve but no limit to just how much you can earn. What does that relate to settling debt? Well, imagine having an additional $1,000/ month (or more) that you could put toward your expenses. The finest part: it's far simpler to earn $1,000 than to slash $1,000 from your spending plan.

Make $1,000, $2,000, even $5,000 or more on the side https://en.search.wordpress.com/?src=organic&q=debt solutions , on a monthly basis, while still keeping your day task. Or-- this is my preferred alternative-- you could give yourself ultimate flexibility and endless earning power with an online organisation. Whatever you pick, the rewards can be big and make a substantial damage in your debt today.

Get Out Of Debt Fast Can Be Fun For Everyone

And earning more cash is the trump card for paying down your debt as quick as possible. Download a free copy of my Ultimate Guide to Making Money http://www.thefreedictionary.com/debt solutions to discover my finest methods for developing several income streams, beginning a service, and increasing your income by countless dollars a year.

Fast Methods Of Financial Debt Solutions - An Ideas Overview

The Facts About Get Out Of Debt Fast Uncovered

These cards typically provide a low or 0% promotional interest rate on transferred balances for a given duration. Since your objective is to get out of debt, you do your research study to guarantee you completely understand the promo. Two questions to ask: https://penzu.com/p/42921de8 What is the balance transfer fee? A lot of balance transfer cards require that you pay a balance transfer charge in between 3 and 5% of the overall amount that you're moving to the new account.

Debt settlement is the procedure of working out with your lenders to pay back just part of your debt. In exchange for a deposit, your lenders consent to forgive the rest of your debt. Sounds respectable, right? Not really. credit history that'll last for seven to ten years. Debt settlement need to be considered more of a last hope.

This next step has to do with purposely altering your habits and habits to guarantee that you're headed towards less debt, not more. Having a plan is fantastic, however you'll probably have to make some way of life adjustments to make that strategy come to life. For instance, you could discover that you presently don't earn enough to stay up to date with the monthly payment goal you developed earlier.

Don't hesitate to think big. Making more can also indicate you request for a raise at work or start trying to find a higher-paying job. Your effort will pay off-- having a little additional cash can go a long method in your effort to get out of debt if you put it towards making extra payments (paying more than the minimum).

Everything about Get Out Of Debt

A common way to find additional money to put towards settling debt is by cutting costs. While numerous (including us!) may argue that consuming at home or bringing your lunch is an easy place to begin, there are numerous ways you can minimize your spending that might not need to feel like a sacrifice.

That's all right. Attempt this to assist you decide where to cut expenses: Take a look at what you're frequently investing money on that does not offer you value. That value can be monetary, psychological, physical; nevertheless you specify value is fine. Debt Management Once you determine that source of costs, eliminating it from your budget plan might not be so hard after all.

Call us crazy, however here's how this might work. Say you spend $150 monthly on your health club membership ($ 1,800 annually). If realistically you're just going a couple of times a year and feel bad about not going regularly, not just is that membership a drain on your finances, however it could possibly be emotionally draining pipes too.

Naturally this example won't resonate with everybody and aspirational gym memberships aren't always a bad thing. The point is to discover something in your costs that isn't giving you value and you can easily cut. Another way to discover money to contribute to your debt is by actually making more cash.

Get Out Of Debt Fast Can Be Fun For Anyone

Beyond trying to increase your earnings, ensure your cash is working for you. If you do not have your cost savings kept in a high-yield cost savings account you might be missing out on cash you might've made in interest. For instance, if you keep $5,000 in a high-yield savings account with an APY of 2.00% for one year, you might make $100 in interest.

It's time to dominate your debt. You can take actions towards becoming debt complimentary , and it all starts here. Get to work on your strategy and payoff plan, and choose if you're a great candidate for consolidation.

Editorial Note: Credit Karma gets settlement from third-party marketers, but that doesn't affect our editors' viewpoints. Our marketing partners don't evaluate, authorize or back our editorial content. It's accurate to the very best of our knowledge when it's posted. Advertiser Disclosure We think it is Click here to find out more necessary for you to understand how we earn money.

The offers for financial products you see on our platform originated from business who pay us. The cash we make helps us give you access to free credit rating and reports and assists us produce our other great tools and academic materials. Compensation may factor into how and where products appear on our platform (and in what order).

The Facts About Financial Debt Solutions Uncovered

That's why we supply functions like your Approval Chances and savings quotes. Naturally, the deals on our platform do not represent all financial products out there, but our objective is to reveal you as lots of great alternatives as we can. Regardless of the factor you may be in debt, rest guaranteed that you're not alone.

According to research from The Seat Charitable Trusts, 80 percent of Americans have some form of debt. So whether your debt is the outcome of an unexpected emergency situation or unexpected overspending, there's no need to feel ashamed about what you owe. However, to avoid paying excessive rates of interest, late fees and falling back on payments, it can be an excellent concept to find out how to get out of debt and create an actionable strategy to meet your objectives.

How's your credit? Check My Equifax ® and Trans Union ® Ratings Now Examine the quantity of debt you owe Discover the details Make a payment plan Keep spending in check Battle tiredness by commemorating little wins Although it may seem difficult, it is essential to comprehend the total quantity of debt you owe.

" Consumers may have several credit cards, and might be uncertain what the total is throughout all of the accounts," describes Andrea Woroch, customer finance and money-saving professional and Marcus by Goldman Sachs ® ambassador. "So having the ability to picture what you owe across various accounts is an important primary step." This can be as easy as putting together a spreadsheet in Excel or connecting your charge card to a free app that will put together the details on your behalf.

The Personal Debt PDFs

According to Woroch, there are three additional information you need to learn about each debt: Due date for each payment Minimum month-to-month payment Rate of interest It is essential to know the information since they will ultimately assist you determine the finest repayment strategy. Common Concern A minimum month-to-month payment is the smallest quantity of money due every month to keep your charge card account in excellent standing.

When you comprehend the big image, it's time to produce a payment strategy. There are two primary debt payment methods. Debt snowball: Coined by personal finance specialist Dave Ramsey, the debt snowball method concentrates on settling the smallest debt first, while preserving minimum monthly payments on all other debts.

This procedure is duplicated till all financial obligations are gone. Although this technique might not conserve you as much money on interest fees, some individuals find it encouraging to settle one account at a time. Debt avalanche: Rather of focusing on the debt with the tiniest balance, the debt avalanche focuses on settling the debt with the greatest interest rate initially, while paying minimum regular monthly payments on all other debts.

Choosing No-Hassle Products In Debt Management

See This Report on Get Out Of Debt Fast

The concern is this-- which debt will you put your additional money towards first? The very first thing is not to get too hung up on this question. Depending on your circumstance, one approach may be better than another, but if you consistently pay for your debt without sustaining more debt, you'll make fantastic development regardless of which debt you pay first.

This technique will lead to the least expensive interest charges and the fastest debt payment possible. Smallest Balance First: This is the Dave Ramsey method. He recommends targeting the debt with the tiniest balance initially. While that debt might not have the highest interest rate, the theory is to get one debt settled as quickly as possible.

First, paying off a debt gives you a feeling of achievement, which might bettystarkweatherlowelluqo9.trexgame.net/helpful-ideas-on-elements-in-financial-debt-solutions be simply the motivation you need to keep on track. Second, by paying of a debt entirely, you free up the money that was required to make month-to-month payments to that expense. While you are most likely to put that money to the next debt, in an emergency situation, you might use it for other functions. With a charge card, as soon as the debt is paid, the card is still there to utilize once again if you so chose. For this factor, I'll typically focus on non-revolving debt first. Why? Since I can't head out and charge up the debt again once it's paid. This is simply a psychological issue, however an important one, particularly if you fear you may lack some discipline once a few of your debt is paid off.

While you might be tempted to put 100% of your additional money towards debt, keeping at least a few of it aside for emergencies will assist break the dependence many have on credit. When the car needs brand-new tires, it's much better to rely on the emergency fund than it is the charge card.

Financial Debt Solutions Things To Know Before You Get This

While most CDs do charge a charge if funds are withdrawn before the end of the term, that penalty can help keep you from accessing the funds for anything other than a true emergency. In addition, there are short-term CDs readily available with 3 or even 1-month terms. When many individuals consider credit reports and credit rating, they see them as important if you desire to apply for a loan.

However your credit report and score are also definitely vital to eliminating debt. With an excellent credit rating, you get approved for lower rate of interest that can help lower your total interest charges. With bad credit, you're stuck paying double digit rates. So let's take a look at some pointers and tools that can help you: Self Loan Provider is an unique business that provides to assist you build your credit report.

After you have actually requested your loan and picked a payment choice, you'll be on the course to building your credit. As soon as you've completed your payments, the entire principal is gone back to you minus the rate of interest. Comprehend the Significance of Your Credit Score: As kept in mind above, your credit rating is an essential tool in getting out of debt as quickly as possible.

Auto loan: With a credit rating of 760, you can expect a car loan rates of interest of about 6.3%. With a rating of 660, the rate increases to about 9.8%. House Equity: Outstanding credit can expect a rate of around 8% or lower, while fair credit customers will pay as much as 11% or higher.

The Basic Principles Of Get Out Of Debt

Get your Free Credit Report: The starting point is to get your totally free credit report and check it for mistakes. Get your Free Credit Report: Next you ought to get your your real FICO rating in exchange for signing up for a totally free trial of a credit watch program. You can always cancel before the end of the complimentary trial if you do not desire to keep the service.

Do whatever is required not to forget a payment, and make sure you make the payment far enough in advance of the due date so that there is no chance it will be late. Do Not Close Accounts: As a basic rule, don't close charge card and other revolving accounts. One of the elements in identifying credit rating is the amount of debt you have in comparison to the amount of available credit.

You can constantly cut up some of your cards if you don't want to run the risk of using them, but do not cancel them. Here are some other suggestions to enhancing your credit history . While you are working to improve your credit, it is essential to be on the lookout for methods to lower the rates of interest on your debt.

Here are some pointers and tools to assist you decrease your rates: Re-finance Your Mortgage: The basic guideline is that you need to refinance if you can lower your interest rate by 1%. While that's an excellent starting point, it is very important to likewise consider the length of time you prepare to remain in the home and whether you need to convert from an adjustable rate home mortgage to a more secure set rate loan.

How Financial Debt Solutions can Save You Time, Stress, and Money.

Work Out Lower Interest on Home Equity Lines of Credit: If you have a house equity line of credit, compare your rate of interest with current market rates. If you think you can do better, step one is to call the home mortgage business and demand a lower rate. We did this successfully with our home equity credit line.

Lower the Interest on Credit Cards: Since rates of interest on credit cards have actually risen so much in the last year, getting a lower rate on charge card debt can save a lot on interest payments. If you have a good credit report, you can certify for a 0% balance transfer charge card .

Beware with Debt Debt Consolidation: While it is important to make the most of the lowest interest rates possible, the one location where you desire to be truly careful is with debt combination companies. While they might guarantee you low rates and a single payment, the number of consumer complaints about such business is exploding.

Here are a number of excellent choices for low rate personal loans . As I stated at the start of this short article, one essential aspect of getting out of debt is investing less and making more. While these topics are the topic of entire books, here are a couple of resources to get you started: Pain-free Cash Conserving Tips: There are greening your house , you'll find plenty of ideas on how to knock hundreds of dollars (or more) off your month-to-month budget plan.

Get Out Of Debt - An Overview

This book puts cash in perspective and was for me a genuine source of inspiration to get out of debt. Earn Additional Earnings: Any extra earnings goes a long way to leaving debt. I've learned this firsthand from the cash I have actually made blogging, all of which either goes to charity or settling debt.

Straightforward Plans In Get Out Of Debt

The 8-Second Trick For Get Out Of Debt

This can decrease the total interest you pay. Many balance transfer charge card even provide a 0% APR for an initial period (frequently 6-18 months). A 0% APR offer permits you a possibility to settle your credit card balance without sustaining extra interest charges. State you have $6,000 of credit card debt at an 18% APR

. If you pay off your debt because duration, you 'd save more than $600 in interest. Keep in mind: You'll probably need to pay a no balance transfer costs . If you have at least decent credit, you might be able to certify for a good balance transfer deal. Save some money by taking a look at our picks for the best balance transfer cards .

Yet, if you remain in a lot charge card debt that you can't pay for to simply write a big check and the debt avalanche technique appears too frustrating or sluggish to handle, it may be time to think about an alternative technique. In circumstances where you have numerous different cards (and declarations, and due dates), paying them off with a low-rate personal loan can be a good concept.

So, paying off your charge card debt with an installation loan might considerably increase your credit, specifically if you don't already have any installation loans on your credit reports. A personal loan can alleviate overload: When you use a personal loan to minimize the number of payments you need to make each month, it can make handling your financial obligations much simpler.

All about Get Out Of Debt

If you qualify for an installment loan with a lower rate, you'll end up paying less cash in general. That being said, getting a loan to settle credit card debt can also threaten. Follow the terms of the loan carefully, or you might simply make your scenario even worse.

Otherwise, you might wind up further in debt. If you use this strategy, keep in mind these bottom lines: Keep credit cards open: Don't close the charge card you settle, unless they have yearly fees you don't wish to pay. Keep them open to assist your credit usage. Cut down on charge card spending: Do not spend any more money on your paid-off credit cards.

Be a responsible borrower: Make regular, punctual payments on your installation loan. If you do not, you'll simply create more issues for your credit. There are lots of places to search for personal loans with a wide range of rates depending upon the lender and your credit rating. You may want to talk to local banks and credit unions where you already have an account.

Here is a non-exhaustive list of online loan providers you may wish to consider (and we may earn a commission if you get a loan through among these links): There are also more detailed services, like Debt.com , that will direct you through the process and assist you determine whether debt combination, credit therapy, insolvency, or other options are the finest suitable for you, however this will likely include extra charges for things you might likely do yourself.

Debt Management for Dummies

Whether the account ultimately injures or assists you depends on two main factors-- how you manage the account and the rest of the information on your credit reports. The application may hurt your scores. When you get credit, a query is contributed to your credit reports. Some credit queries may damage your scores for 12 months (though the effect is typically small).

Initially, a new account might decrease your typical age of credit and adversely impact your ratings. As your personal loan grows older, it might help those numbers. A personal loan could lower your credit usage. Personal loans are installment loans, which don't impact your revolving usage ratio at all.

If you pay off charge card with a personal loan, your revolving utilization ratio must decrease, and your scores may enhance. Your credit mixture may enhance with a personal loan. Scoring models reward you for having a varied mix of accounts on your credit reports. If you don't have any installment loans on your reports, adding a personal loan may assist your scores.

Just make certain liveinternet.ru/users/xippusmhis/post465963167// you make every payment on time. If you open a personal loan and pay it late, it could damage your scores substantially. Program Hide Debt settlement is another choice you can think about when you're prepared to remove your charge card debt. This technique usually works finest for individuals who (a) are currently past-due on their charge card payments and (b) can manage to make large, one-time settlement payments to their financial institutions.

About Debt Management

You may be qualified if you've gone through challenges like task loss, medical issues, or divorce. Nevertheless, some financial institutions will consider settling financial obligations even if you do not have any special extenuating circumstances. When you settle your debt, you can sometimes pay 50% or less of the original balance. You may, however, need to pay taxes on the forgiven amount.

If you select to employ an outside celebration, you should do substantial research to avoid fraudsters and exorbitant costs. Discover what to view out for at the FTC Consumer Details website . When you've reached your limits and have no place else to turn, bankruptcy can ravage your credit . There are 2 types of personal insolvency: Chapter 7, which often needs you to give up a few of your property.

Declaring either kind of personal bankruptcy can be a long, costly process-- consisting of attorney and court filing fees-- and you should not take it gently. Before submitting personal bankruptcy, you need to likewise seek credit counseling authorized by the department of justice. When you're swimming in red-letter expenses and harassing call, it can typically seem like there's no method out.

This post consists of links which we might receive compensation for if you click, at no charge to you. Climbing out of debt can feel like an insurmountable mountain. There are thousands of books, recommendations, evaluations, and obvious professional responses out there. While there are numerous techniques for getting out debt, I'm going to share exactly what I discovered paying for $80,000 in charge card, student loan, and other debt.

Personal Debt - Questions

Lots of people much like you remain in the exact very same scenario. Breathe, and know that there are resources out there for you. Look for a neighborhood to assist develop you up. You are not alone. Developer of Millennial Cash and Author of.

If provided the choice, would you rather lose 5 pounds or save $5,000 this year?When asked that concern, many people (84 percent) said saving cash would debt management scheme be the higher priority, according to a Instagram .

However, prior to you accept paying the present rates of interest on your arrearage, there might be ways to reduce these rates. If you realize that you're making high interest payments to several lenders, or you're overwhelmed by all the different lending institutions you owe cash to, debt consolidation might assist get your debt under control.

The result might be a lower regular monthly payment and a lower rates of interest. When you're trying to get out of debt, you wish to maximize every dollar. If you get approved for a lower rate of interest, combining your debt might conserve you money that you can put towards Get Out of Debt Fast paying for the Take a look at the site here principal on your debt.

A Breakdown Of Uncomplicated Strategies Of Debt Management

Some Of Get Out Of Debt

Legal Disclaimer: This website is for instructional purposes and is not a replacement for professional guidance. The product on this site is not intended to supply legal, investment, or financial advice and does not suggest the schedule of any Discover services or product. It does not guarantee that Discover provides or backs a service or product. Assuming you have a normal 30-year home loan, you could increase the amount of your monthly payment, which will help you retire your loan early and minimize interest. By paying an additional $100 a month on a 30-year, $200,000 mortgage with 25 years remaining and a 4.5% Helpful resources rate of interest, you 'd conserve almost $21,000 in interest and be out of debt practically 4 years early, according to a Bankrate home loan calculator.

There's lots of cookie-cutter financial suggestions out there: Earn more money. Cut up your credit cards. Eat out less. Make driscollbarbaratillmanlis2.tumblr.com/post/190551327917/emerging-guidelines-for-rapid-solutions-of-debt coffee in your home. All of these apparent tips should be satisfied with sarcastic interest, so don't pick up the scissors and cut up all your charge card just yet. Here are some practical techniques for how to get out of debt.

For example, you may be able to work out down medical debt or tax debt. With mortgage and auto debt, you might think about refinancing. If you have credit card debt throughout multiple accounts, you could combine. Your best method to get out of debt will depend upon your unique monetary circumstance.

Pay off your highest-interest debt first Pay off your smallest balance first Set your own objective with a debt payoff calculator Meet with a debt counselor to form a repayment strategy Consolidate debt with a personal loan or balance transfer credit card The debt avalanche approach includes settling your debt with the highest interest rate first, and working your method below there.

Financial Debt Solutions Things To Know Before You Buy

In the meantime, you'll continue making minimum payments on your other debts-- you'll just be allocating additional money toward your priority debt. Tackle your debt in baby actions utilizing the debt snowball technique . You'll target your debt with the most affordable balance first while making the minimum payment on your other debts.

This repayment approach helps you cut down the variety of financial obligations you owe and offers you small wins to keep you encouraged on your payment journey. Using the same example above, attempt the exercise with debt quantities: $1,000 rewards credit card debt $1,500 installment plan card debt $10,000 car loan debt $35,000 student loan debt $150,000 home mortgage debt Compared to the above example, you'll discover that this list didn't change much.

Utilize an online debt reward calculator to determine http://www.bbc.co.uk/search?q=debt solutions just how much you should designate towards your debt in order to pay it off within a particular amount of time. Let's state you set a personal goal to pay off your $2,500 credit card debt in 2020. Online debt calculators let you plug in your debt, interest rate and reward date.

Here's what that appears like if you have a store credit card and a rewards charge card using the examples above: This provides you a clearer image of how much you'll pay each month, and just how much you'll pay in interest in the long run. You might even choose that you can pay off those charge card earlier to avoid accumulating more interest.

Get Out Of Debt Fast Things To Know Before You Buy

The finest part about using a debt payoff calculator is that you can tailor your technique to pay off debt based on just how much you can put aside monthly. Debt therapy, likewise referred to as credit counseling, is when you meet a licensed credit therapist who will: Deal cash and debt advice Assist you establish a budget plan Offer you educational materials on finance Credit therapy companies are primarily nonprofits that provide affordable or complimentary debt counseling.

Debt management plans come at a cost, generally a month-to-month fee. You can find a certified credit therapist by searching the Financial Counseling Association of America . If you're having a hard time with debt, you might think about debt combination so you can repay your fees with a much better rates of interest. This payment technique likewise permits you combine multiple financial obligations into one, enabling you to make simply one regular monthly payment instead of several payments.

The catch: Both of these debt payment alternatives may run out grab those with lower credit profiles. You'll have a difficult time securing an excellent rate on a personal loan with bad credit, and you'll discover it challenging to qualify for a balance transfer credit card without a great credit report.

50/30/20 budget plan: Allocate part of your income to debt Zero-based budget: Represent every dollar made Envelope budget plan: Put precisely enough aside for each spending category Debt-free way of life: Live like a minimalist to prevent the very same errors The 50/30/20 budget plan was promoted by Mass. Senator Elizabeth Warren in her 2005 book "All Your Worth: The Ultimate Life Time Cash Strategy." It works like this: 50% of your budget should approach your requirements, like home mortgage or rent, utilities, healthcare, groceries, transportation and child care.

Not known Facts About Debt Management

20% of your spending plan need to approach savings and paying off debt, like charge card and trainee loans. Under this guideline, you need to be paying a good chunk of modification https://www.washingtonpost.com/newssearch/?query=debt solutions towards your debt monthly. If you have the self-discipline, you could even try turning the 20% and 30% so that you can put more towards debt repayment, or perhaps attempt something closer to 50/25/25.

To put it simply, you are accounting for every dollar of income you bring in every month, even cost savings and debt payments, so you have $0 remaining at the end of the month. Let's state you bring in $4,000 monthly after taxes, retirement and healthcare are taken out of your Get Out of Debt income.

Get out of debt the old-fashioned way by making use of the reliable envelope spending plan. Here's the basic concept of this budget plan: Label envelopes for each costs classification, such as dining out, energies and groceries. Estimate how much you'll invest month-to-month on your expenses, and put a set amount of cash in each envelope.

While it bores to do this month after month, you may consider trying it for a few months just to get a better concept of where you spend your hard-earned money. For example, Check over here you may discover that you invest more on groceries than you had actually allocated, or you might learn that you're spending more on heading out to the bar than you recognized.

Get Out Of Debt Fast for Beginners

If your debt is due to charge card http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/debt solutions overspending, then it may be time to retire your charge card, or just use certain cards in such a way that's more workable. Remember that credit cards are a tool, not a crutch. You might think about reducing to a more modest home or cars and truck, also.

Selecting Speedy Plans In Get Out Of Debt

The Get Out Of Debt Fast Ideas

If you can only discover a card with a low introductory rate, maximize the value of that low-interest period. By paying off your balance aggressively, you will reduce the balance more rapidly than you will when the rate increases. You can likewise call your existing credit card companies to ask about debt consolidation and lower rates.

Even a percentage point or more can make a difference with a sizable balance. Obtain only for the long term. The best usage of debt is to finance things that will gain in value, such as a house, an education, or big-ticket requirements, like a cleaning machine or a computer, that will still be around when the debt is settled.

By the time the balance is gone, you'll have paid far more than the expense of these items and have nothing however memories to show for it. By evaluating your spending, controlling expenses, and establishing a plan, you can reduce-- and possibly remove-- your debt, leaving you with more money to conserve today and a better Learn more here outlook for your financial future.

Quantity represents revolving charge card balances-- those that are brought from month to month-- rather than all charge card balances. © DST Systems, Inc. Recreation in whole or in part restricted, other than by permission. All rights scheduled. Not accountable for any mistakes or omissions. This material is authored by DST Systems, Inc

Personal Debt Things To Know Before You Get This

. Assumptions, viewpoints and price quotes make up judgment from DST Systems, Inc. since the date of this product and undergo alter without notice. Past efficiency does not guarantee future outcomes. The details consisted of in this product does not make up recommendations on the tax repercussions of making any specific financial investment decision.

Prior to acting upon any suggestion in this product, you need to think about whether it appropriates for your particular situations and, if needed, look for professional recommendations. Any opinions expressed herein are offered in excellent faith, are subject to change without notice, and are only right as of the stated date of their issue.

or its sources, neither DST Systems, Inc. nor its sources guarantees the accuracy, adequacy, efficiency or schedule of any information and is not accountable for any errors or omissions or for the outcomes gotten from making use of such details. In no event shall DST Systems, Inc. be liable for any indirect, special or substantial damages in connection with customer's or others' use of the material.

and affiliated banks. Members FDIC and completely owned subsidiaries of Bank of America Corporation. Merrill, its affiliates, and financial consultants do not provide legal, tax, or accounting suggestions. You must consult your legal and/or tax consultants before making any monetary choices. AR 7GM 9H 5-EXP 071920.

How Debt Management can Save You Time, Stress, and Money.

Here is among the most regularly asked questions in all of personal finance: "How do I get out of debt?" At one level, getting rid of debt is just about following a couple of actions: Stop going into more debt Spend less than you make Pay off debt with the distinction If you follow these steps, eventually you'll be debt free.

And to make matters worse, there is a lot of "help" out there that's not really valuable. From debt consolidation companies to books like Kevin Trudeau's "Debt Cures" that I would not advise to my worst opponent, there are a lot of guarantees being made that leaving debt is easy.

In truth, tackling your debt may be one of the hardest things you'll ever do. You need to control your emotions, which can play a big part in how we make financial choices. You need to inform yourself about whatever from house loans to credit cards to credit rating. And you need to discipline yourself in the way you handle and invest money.

But fortunately is that you can do it. If you wish to be debt-free bad enough, you can make it take place. And to help you reach your goal of being debt-free, I have actually put together a list of 23 pointers and tools. If you understand of others, please leave a comment at the bottom of this post.

The Ultimate Guide To Personal Debt

When it pertains to debt, you ought to know everything about the terms and conditions of the cash you owe. Here are some pointers and tools to assist you understand your debt. Put Your Debt On Paper: The really first step is make a list of the financial obligations you have. The list must consist of the following information: The name, address and telephone number of the creditor; the exceptional balance; the rate of interest; the minimum payment; and any other details you feel is crucial.

Take Benefit of Personal Finance Software application: By now lots of people currently have and utilize personal finance software application like Quicken. If so, you can use the tools within the software application to tape all of the debt Find more info you owe and to establish a strategy to settle that debt. Use Free Online Tools: There are numerous budget tools available online totally free .

And it's difficult to beat free! Use Free Excel Templates: Microsoft uses free Excel design templates that can help you track your debt and a budget plan. In fact, Microsoft provides free design templates for practically whatever, consisting of resumes. You can take a look at the free budget design templates here . Include Others: It is necessary that your partner or loved one is associated with the process.

It's not uncommon for one spouse to take the lead in dealing with financial resources, which's fine. But you both need to be on board, especially as you develop a plan to take on the debt. After you have actually composed down all your financial obligations, it's now time to identify how you will go about settling these costs.

The Greatest Guide To Personal Debt

It's just your method to tackling your debt. There is no one single approach; you need to do what works best for you and your family. There are, nevertheless, some important considerations and tools that can help you establish an effective debt repayment strategy: Debt Payment Calculator: As a starting point, it's valuable (and in some cases agonizing) to see for how long it will take you to settle your debt if you make just the minimum payments.

While the plan will include making additional payments, the beginning point is to understand what you are up against making simply the minimum payments on your debt, and this calculator will help you do just that. Prepare a Spending plan: For numerous, the word "budget" is the dreaded "B" word. But the fact is that you require a budget plan to manage your spending and much better handle your money.

Here are a couple of spending plan related posts that can get you started: Be Aggressive About Settling Debt: Dave Ramsey speaks about tackling debt with "gazelle" intensity. It's about being aggressive in paying off your debt. As you work through your budget plan, acknowledge that every dollar counts, which the more you throw at your debt, the less interest you'll pay and the much faster you'll get out of debt.

Methods For Get Out Of Debt - An Updated Intro

Little Known Facts About Get Out Of Debt.

When you miss out on a payment, your lender might report it to the credit bureaus-- an error that can remain on your credit reports for 7 years. You juliajunestarkweatheris6l.fotosdefrases.com/personal-debt-the-growing-opportunities may likewise have to pay late charges, which will not affect your credit scores, however can be troublesome nonetheless. Aside from your payment history, the method each kind of debt affects your credit is quite various. Charge card companies can draw you in with a manage your brand-new credit card account the ideal way . The factor revolving debt can be so overwhelming is because charge card interest rates are generally truly high. So, if you're just making the minimum payment every month, it will take you a long time to pay off your balance-- potentially years.

Let's state you charge $8,000 on a charge card with 17% APR, and then put it in a drawer, never spending another cent. If you make just the minimum payment on that costs monthly, it might take you practically 16 years to settle your debt-- and cost you almost $7,000 extra in interest (depending upon the terms of your contract).

If you just have one debt, your strategy is basic: make the biggest regular monthly debt payment you can handle. Rinse and repeat, up until it's all gone. But if you resemble the majority of people in debt, you have numerous accounts to handle. Because scenario, you require to find the debt removal approach that works best for you.

We'll discuss both of those approaches listed below, as well as alternatives like balance transfers, personal loans, and personal bankruptcy. We advise using the debt avalanche technique considering that it's the finest method to pay off several credit cards when you desire to lower the amount of interest you pay. But if that technique isn't ideal for you, there are a number of others you can consider.

Get This Report on Financial Debt Solutions

Here's how it works: Step 1: Make the minimum payment on all of your accounts. Action 2: Put as much additional money as possible toward the account with the greatest rates of interest. Action 3: Once the debt with the highest interest is settled, start paying as much as you can on the account with the next greatest rate of interest.

Each time you pay off an account, you'll free up more money monthly to put towards the next debt. And because you're tackling your debts in order of rate of interest, you'll pay less general and get out of debt faster. Like an avalanche, it might take a while before you see anything occur.

Let's state you have 4 various financial obligations: Type of Debt Balance Interest Rate (APR) Car Loan $15,000 4.5% Charge card $7,000 22.0% Student Loan $25,000 5.5% Personal Loan $5,000 10.0% To utilize the debt avalanche method: Always pay the monthly minimum necessary payment for each account. Put any additional money toward the account with the highest interest rate-- in this case, the charge card.

When the personal loan is settled, take what you've been paying and add that total up to your payments for the student loan debt. Once the trainee loan is paid off, take the cash you've been paying toward other financial obligations and add it to your payments for the automobile loan.

Personal Debt - Questions

You'll likewise have the complete satisfaction of seeing the highest interest rates vanish. That's why the debt avalanche is our advised method for paying off debt. The drawback? It'll typically take longer to see development than with the debt snowball. So if you're counting on some little wins to get you inspired, the next method might be a much better fit for you.

Lots of individuals like this method because it includes a series of small successes at the start-- which will give you more motivation to settle the rest of your debt. There's also the potential to enhance your credit ratings quicker with the debt snowball approach, as you debt management uc lower your credit usage on private charge card quicker and decrease your number of accounts with exceptional balances.

Step 2: Put as much extra money as possible towards the account with the tiniest balance. Step 3: Once the tiniest debt is settled, take the cash you were putting toward it and funnel it toward your next smallest debt instead. Continue the process till all your debts are paid.

As soon as that's paid off, you concentrate on the account with the next tiniest balance. Think about a snowball rolling along the ground: As it grows, it can select up increasingly more snow. Each dominated balance offers you more money to assist settle the next another quickly.

Some Known Questions About Personal Debt.

Plus, the debt snowball technique might have a positive influence on your credit history (particularly if you opt to eliminate charge card debt first). Much better credit can conserve you money in other locations of your life also. Let's take the same accounts we utilized in the very first example. Type of Debt Balance Rate Of Interest (APR) Car Loan $15,000 4.5% Credit Card $7,000 22.0% Student Loan $25,000 5.5% Personal Loan $5,000 10.0% To utilize the debt snowball method: Always pay the month-to-month minimum required payment for each account.

As soon as the personal loan is settled, utilize the cash you were putting towards it to vanquish the next tiniest balance-- the credit card debt. When the charge card is paid off, take the money you have actually been paying towards other financial obligations and add it to your payments for the auto loan.

Using the debt snowball method, you'll end up settling your accounts in this order: Personal Loan ($ 5,000) Credit Card ($ 7,000) Automobile Loan ($ 15,000) Student Loan ($ 25,000) The debt snowball can be a great fit if you have several little debts to pay off-- or if you need motivation to settle a lot of debt.

When you're dealing with a frustrating quantity of debt, this technique lets you see progress as rapidly as possible. By eliminating the tiniest, easiest balance initially, you can get that account out of your mind. Minimizing the number of accounts with impressive balances on your credit reports may assist your credit report too.

Get This Report about Personal Debt

Since you don't take rates of interest into account, you could end settle higher-interest accounts later on. That extra time will cost you more in interest fees. While the debt snowball and avalanche are two overarching methods for how to settle debt, here are some particular techniques you can use in conjunction with them.