Fast Methods Of Financial Debt Solutions - An Ideas Overview

The Facts About Get Out Of Debt Fast Uncovered

These cards typically provide a low or 0% promotional interest rate on transferred balances for a given duration. Since your objective is to get out of debt, you do your research study to guarantee you completely understand the promo. Two questions to ask: https://penzu.com/p/42921de8 What is the balance transfer fee? A lot of balance transfer cards require that you pay a balance transfer charge in between 3 and 5% of the overall amount that you're moving to the new account.

Debt settlement is the procedure of working out with your lenders to pay back just part of your debt. In exchange for a deposit, your lenders consent to forgive the rest of your debt. Sounds respectable, right? Not really. credit history that'll last for seven to ten years. Debt settlement need to be considered more of a last hope.

This next step has to do with purposely altering your habits and habits to guarantee that you're headed towards less debt, not more. Having a plan is fantastic, however you'll probably have to make some way of life adjustments to make that strategy come to life. For instance, you could discover that you presently don't earn enough to stay up to date with the monthly payment goal you developed earlier.

Don't hesitate to think big. Making more can also indicate you request for a raise at work or start trying to find a higher-paying job. Your effort will pay off-- having a little additional cash can go a long method in your effort to get out of debt if you put it towards making extra payments (paying more than the minimum).

Everything about Get Out Of Debt

A common way to find additional money to put towards settling debt is by cutting costs. While numerous (including us!) may argue that consuming at home or bringing your lunch is an easy place to begin, there are numerous ways you can minimize your spending that might not need to feel like a sacrifice.

That's all right. Attempt this to assist you decide where to cut expenses: Take a look at what you're frequently investing money on that does not offer you value. That value can be monetary, psychological, physical; nevertheless you specify value is fine. Debt Management Once you determine that source of costs, eliminating it from your budget plan might not be so hard after all.

Call us crazy, however here's how this might work. Say you spend $150 monthly on your health club membership ($ 1,800 annually). If realistically you're just going a couple of times a year and feel bad about not going regularly, not just is that membership a drain on your finances, however it could possibly be emotionally draining pipes too.

Naturally this example won't resonate with everybody and aspirational gym memberships aren't always a bad thing. The point is to discover something in your costs that isn't giving you value and you can easily cut. Another way to discover money to contribute to your debt is by actually making more cash.

Get Out Of Debt Fast Can Be Fun For Anyone

Beyond trying to increase your earnings, ensure your cash is working for you. If you do not have your cost savings kept in a high-yield cost savings account you might be missing out on cash you might've made in interest. For instance, if you keep $5,000 in a high-yield savings account with an APY of 2.00% for one year, you might make $100 in interest.

It's time to dominate your debt. You can take actions towards becoming debt complimentary , and it all starts here. Get to work on your strategy and payoff plan, and choose if you're a great candidate for consolidation.

Editorial Note: Credit Karma gets settlement from third-party marketers, but that doesn't affect our editors' viewpoints. Our marketing partners don't evaluate, authorize or back our editorial content. It's accurate to the very best of our knowledge when it's posted. Advertiser Disclosure We think it is Click here to find out more necessary for you to understand how we earn money.

The offers for financial products you see on our platform originated from business who pay us. The cash we make helps us give you access to free credit rating and reports and assists us produce our other great tools and academic materials. Compensation may factor into how and where products appear on our platform (and in what order).

The Facts About Financial Debt Solutions Uncovered

That's why we supply functions like your Approval Chances and savings quotes. Naturally, the deals on our platform do not represent all financial products out there, but our objective is to reveal you as lots of great alternatives as we can. Regardless of the factor you may be in debt, rest guaranteed that you're not alone.

According to research from The Seat Charitable Trusts, 80 percent of Americans have some form of debt. So whether your debt is the outcome of an unexpected emergency situation or unexpected overspending, there's no need to feel ashamed about what you owe. However, to avoid paying excessive rates of interest, late fees and falling back on payments, it can be an excellent concept to find out how to get out of debt and create an actionable strategy to meet your objectives.

How's your credit? Check My Equifax ® and Trans Union ® Ratings Now Examine the quantity of debt you owe Discover the details Make a payment plan Keep spending in check Battle tiredness by commemorating little wins Although it may seem difficult, it is essential to comprehend the total quantity of debt you owe.

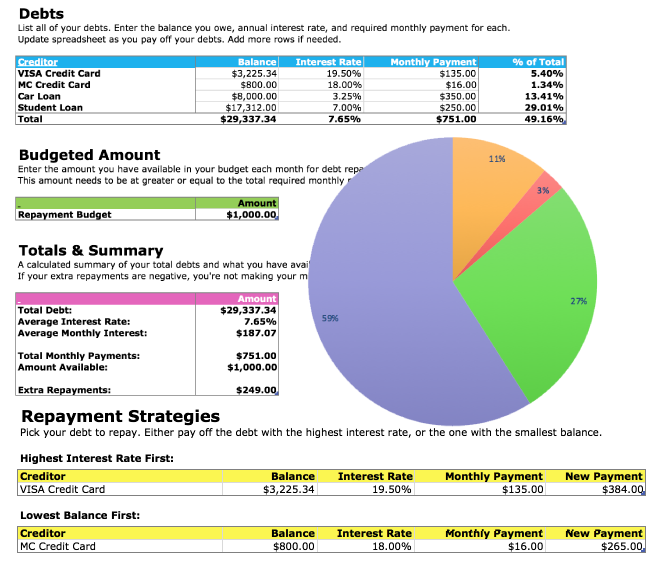

" Consumers may have several credit cards, and might be uncertain what the total is throughout all of the accounts," describes Andrea Woroch, customer finance and money-saving professional and Marcus by Goldman Sachs ® ambassador. "So having the ability to picture what you owe across various accounts is an important primary step." This can be as easy as putting together a spreadsheet in Excel or connecting your charge card to a free app that will put together the details on your behalf.

The Personal Debt PDFs

According to Woroch, there are three additional information you need to learn about each debt: Due date for each payment Minimum month-to-month payment Rate of interest It is essential to know the information since they will ultimately assist you determine the finest repayment strategy. Common Concern A minimum month-to-month payment is the smallest quantity of money due every month to keep your charge card account in excellent standing.

When you comprehend the big image, it's time to produce a payment strategy. There are two primary debt payment methods. Debt snowball: Coined by personal finance specialist Dave Ramsey, the debt snowball method concentrates on settling the smallest debt first, while preserving minimum monthly payments on all other debts.

This procedure is duplicated till all financial obligations are gone. Although this technique might not conserve you as much money on interest fees, some individuals find it encouraging to settle one account at a time. Debt avalanche: Rather of focusing on the debt with the tiniest balance, the debt avalanche focuses on settling the debt with the greatest interest rate initially, while paying minimum regular monthly payments on all other debts.