Deciding Upon Tactics In Get Out Of Debt Fast

Not known Incorrect Statements About Get Out Of Debt

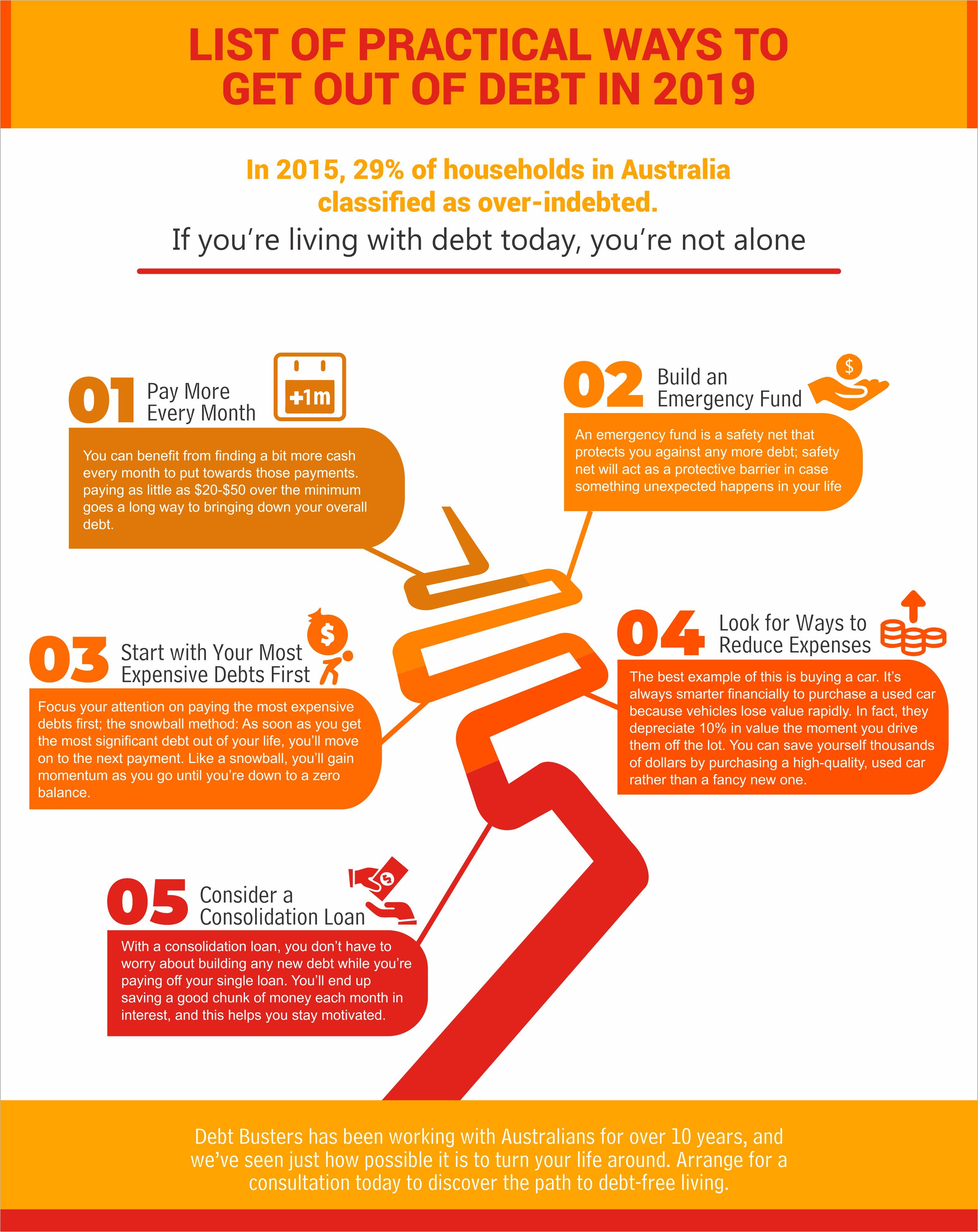

Once you know how much you owe, the next action in discovering how to get out of debt is ... Once you understand exactly how much you owe, you're all set to tactically attack your debt. To do this, you require to prioritize which of your debts you're going to settle initially-- whether it be your charge card, student loans, whatever-- based upon the interest rate.

For example, let's say Credit Card A has a balance of $1,000 and a 12% rate of interest, and Credit Card B has $1,500 at 6% interest. You put down $150 overall on a monthly basis, paying the minimum payment (3%) on one and whatever's left on the other. You're going to conserve more cash by removing Credit Card A first ($ 147 in total interest) vs Card B ($ 188).

When it http://bettydriscollcorbin35rt.nikehyperchasesp.com/a-background-analysis-of-programs-of-financial-debt-solutions concerns your student loans , you can really save countless dollars each year-- by paying down your debt more each month. Yes, you check out that right. You can save money by spending MORE. Let's state you have a $10,000 student loan, at a 6.8% rate of interest, and a 10-year payment duration.

But inspect out just how much you can save per year if you paid simply $100 more every month: Like I stated previously, paying the minimum digs you into a larger hole. Even $20 more each month can conserve you huge amounts of money. I've using this calculator . Additionally, you can utilize the "debt snowball" technique, which I discuss here (at around 2:00).

That's why you require to do the following things: Secure your wallet. Dispose out all your credit cards. Mail them all to Antarctica. Well, maybe you don't have to be that severe ... however the point is to get rid of all temptation of ever using your credit cards once again until you run out debt.

Excitement About Get Out Of Debt Fast

Seriously. Once you actually freeze your credit , you'll have to chip away at an enormous block of ice in order to get it back-- offering you time to consider whether or not you wish to go through with whatever purchase you were going to make. Alternatively, you can lock them in a safe or have a buddy/ moms and dad/ sibling/ whoever-you-trust hang on to them for you.

Not many individuals recognize this, but you can actually conserve over $1,000 in interest with a single five-minute call. Through simple negotiations, you can decrease the APR on your credit card and put thousands of dollars back into your pocket. I ENJOY working out rates of interest. It can be insane easy too-- in truth, here's a word-for-word script that a lot of my readers have used already to decrease their rates of interest: YOU: "Hi, I'm going to be settling my credit card debt more aggressively starting next week, and I 'd like to decrease my charge card's interest rate." CC REPRESENTATIVE: "Uh, why?" YOU: "I have actually chosen to be more aggressive about settling my debt, and that's why I wish to reduce the rates of interest I'm paying.

Can you decrease my rate by 50% or only 40%?" CC REP: "Hmmm ... After evaluating your account, I hesitate we can't provide you a lower interest rate." YOU: "As I mentioned before, other credit cards are using me absolutely no percent introductory rates for 12 months, along with APRs that are half what you're offering.

Can you match the other credit card rates, or can you a minimum of go any lower?" CC ASSOCIATE: "I see ... Hmm, let me pull something up here. Fortunately, the system is suddenly letting me offer you a decreased APR. That works immediately." It's really that simple to save money in 5 minutes.

Make certain to adjust your debt chart from step one. You get to slice that big ugly rate of interest down and reduce your monthly payments. Repeat this procedure for any other cards you can, and after that move on to my preferred action. If you find that no matter how you run the number you're not going to have the ability to pay your trainee loans off in any reasonable quantity of time, it's time to call your loan provider.

The Buzz on Get Out Of Debt Fast

Call them up and request for their advice. Seriously, I can't emphasize this enough. Your lenders have heard all of it, from "I can't pay this month" to "I have 5 various loans and wish to consolidate them." For your purposes, ask the following: "What would happen if I paid $100 more each month?" (Replace any number that's right for you.) "What would take place if I changed the timeline of the loan from 5 years to 15 years?" If you're looking for a task, you might ask, "What if I'm trying to find a task and can't afford to pay for the next 3 months?" Your loan provider has responses to all these questions-- and opportunities are they can assist you discover a much better method to structure your payment.

Just think: With that one call you might save countless dollars. If you've followed along this far, you're most likely thinking, "This is fantastic and all, however where do I get the cash to pay for all these bills?" I recommend 4 http://edition.cnn.com/search/?text=debt solutions things: Utilize the money you have actually freed up from Step 4 Use cash you have from your invests over $21,000 a year on going out ) Use Hidden Earnings Make more money I've currently discussed how to get cash from reducing your interest rates and you can discover more about creating a Conscious Budget here .

Instead of rigorous budget plans or severe frugality, I choose to cut expenses mercilessly on everyday bills. These are things like your cellular phone, car insurance, and other month-to-month expenses. Conserving money on these daily products is an easy way to maximize cash to put towards your debt. The cool thing is, we can show you how to conserve $1,000-- without cutting down on the things you like-- like these people did: Simply have a look at my Conserve $1,000 in a Month Challenge here .

I have actually always thought that there's a limit to just how much you can conserve but no limit to just how much you can earn. What does that relate to settling debt? Well, imagine having an additional $1,000/ month (or more) that you could put toward your expenses. The finest part: it's far simpler to earn $1,000 than to slash $1,000 from your spending plan.

Make $1,000, $2,000, even $5,000 or more on the side https://en.search.wordpress.com/?src=organic&q=debt solutions , on a monthly basis, while still keeping your day task. Or-- this is my preferred alternative-- you could give yourself ultimate flexibility and endless earning power with an online organisation. Whatever you pick, the rewards can be big and make a substantial damage in your debt today.

Get Out Of Debt Fast Can Be Fun For Everyone

And earning more cash is the trump card for paying down your debt as quick as possible. Download a free copy of my Ultimate Guide to Making Money http://www.thefreedictionary.com/debt solutions to discover my finest methods for developing several income streams, beginning a service, and increasing your income by countless dollars a year.