Some Updated Guidance On Necessary Elements For Get Out Of Debt

A Biased View of Financial Debt Solutions

Paying off debt can be discouraging and complicated if you don't have the right strategy. For more than 25 years, Dave Ramsey has taught people a step-by-step technique to slashing their debt called the 7 Child Steps . On Infant Action 1, you save $1,000 in an emergency fund, and on Baby Action 2, you settle all your debt using a method called the debt snowball.

Assault the smallest debt with a revenge, while making minimum payments on the rest of your debts. Repeat this technique as you rake your way through debt. Look, Baby Step 2 takes a couple of months to complete for some individuals and a few years for others. So if you're on this step and laser-focused on settling that last debt, it's possible the grind is starting to end up being.

well, a grind. Maybe you're exhausted, and feel like it's going to take permanently to become debt-free. Hold that thought, since we're here to offer you ideas on how to end up being debt-free earlier. Here are 25 ways to get out of debt. You've most likely heard this a thousand times-- but are you doing it? You can save a heap of cash just by revealing a discount coupon to the cashier.

That's how you wind up with 10 bottles of spicy mustard sitting in your pantry. Get a FREE customized plan for your cash in 3 minutes! Let's be genuine: Kids grow out of clothing at the speed of light. It's not worth it to enter into debt for your two-year-old's wardrobe.

10 Easy Facts About Financial Debt Solutions Explained

If you 'd rather go shopping online, no problem. Websites like thred UP and Swap.com are excellent resources to get adult and children's clothing at a portion of the expense. Welcome to this millennium, where you can debt snowball starts rolling. We get it. Going to a dining establishment or striking up the drive-thru is a lot simpler than cooking in your home.

For an imaginative way to socialize and share a meal, have buddies over for taco night rather of meeting up at a dining establishment. If you do not know where all your cash is going every month, we're pretty sure your preferred coffeehouse can find it for you. Brewing your own coffee in your home is a simple way to conserve cash quick.

Make a list and stick to it! Use the calculator app on your phone while you search the aisles to make sure you're staying with your spending plan. Do impulse products always end up in your cart? Try purchasing your groceries online and after that selecting them up curbside at the shop.

Do you spend a load at craft stores however never get around to starting your task? Home improvement shops can likewise cost you several Benjamins in one go to. You can still choose a run outside-- for totally free. Collect some pals and begin a running club. Put a spending freeze on your entertainment expenses for a little while.

Debt Management - Questions

Rather, difficulty yourself to https://en.search.wordpress.com/?src=organic&q=debt solutions find complimentary ways to remain amused. Take the kids to the park, opt for a walk or a hike, take pleasure in a free concert, or look for a free event in your community. Starting your own company has never been much easier! Do you have a flair for making things? Offer your products online! Are you an animal enthusiast? Take up pet walking or family pet sitting.

Christy Wright's Service Shop is an excellent resource to stroll you through the process! Not into beginning your own business? Then consider becoming a driver for Lyft or Uber. A pizza shipment job in the evening might likewise bring in additional money. You can even deliver other types of food in your extra time by working for places like uber EATS or Grubhub.

But that's a little sacrifice for extra money in your pocket. The average regular monthly payment for a brand-new vehicle is $523.( 1 ) That's just outrageous! How much faster could your debt snowball relocation if you applied that $500 to it each month? Shred 'em. Burn 'em. Shoot 'em. You'll never ever get out of debt till you stop making debt a way of living.

Ouch! No one likes that. People tend to invest less when paying in cold, hard money. With the Yep, you check out that right. And yes, we even indicate stop adding to your 401( k). Today, you desire all your earnings to go towards getting out of debt. As soon as you're debt-free and have saved three to six months of costs in an emergency situation fund, then you can resume your contributions.

What Does Debt Management Do?

Stop trying to stay up to date with the Joneses! Keep in mind, you're living like http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/debt solutions nobody else now so that later on you can live like nobody else! In twenty years, you will not have a financial concern worldwide while everyone else will still have vehicle loan, home loans and credit card bills.

When it http://edition.cnn.com/search/?text=debt solutions concerns cash, the kids can be a worse guide than your stomach. Be open with them about what you do and don't have room for in the budget plan. And remember: Never ever be afraid to utilize that magic word, "no." Listening to the program will encourage you when you feel like you aren't making development.

Their successes will motivate you to keep progressing. What do you have to lose? You miss 100% of the shots you do not take. Make it a brand-new part of your vocabulary. Love it. Embrace it. Since when it comes to spending money, you'll be saying it quite frequently. A single person's trash is another person's treasure.

Wait a minute-- give? Yes! Providing changes your spirit. Make providing a top priority in your budget, and you'll see a distinction. Financial Peace University is the class that begins you on your journey to never ever stress over cash again. Sure, you can settle your costs on your own, but FPU adds rocket fuel to your debt-free goals.

An Unbiased View of Get Out Of Debt

If you have actually currently taken Financial Peace University, consider leading a group. It is among the finest ways you can remain gazelle extreme and keep http://www.moneysense.ca yourself responsible! Not to discuss, you'll be helping change somebody's life. View what takes place when you end up being an FPU coordinator and help others win with money.

Attempt a few of these pointers and see if they work for you. When you struck a wall and http://www.credit.com feel like you'll never figure out how to get out of debt, just keep working the strategy! Over time, your dedication will pay off! Discover more about Financial Peace University . .

Shaking Turn Over Property Deal. http://www.listenmoneymatters.com/how-to-get-out-of-debt/ Big Stock Picture If you have actually been carrying around certain debts for a long period of time, particularly uncollectable bills that do not have worth or diminish in worth, it's more effective to pay them off completely, as accounts that are shown as "paid in complete" on your credit report assist your credit rating.

While the company works out with your creditors, you make no payments, and after that the business makes payments on your behalf. However, while you wait for the negotiation of the settlement to occur, you'll get calls from financial institutions, and the Hop over to this website late payments will stay on your credit reports for 7 years, damaging your credit rating.

The Most Pervasive Problems In Residential Mortages

The 7-Second Trick For Reverse Mortgage

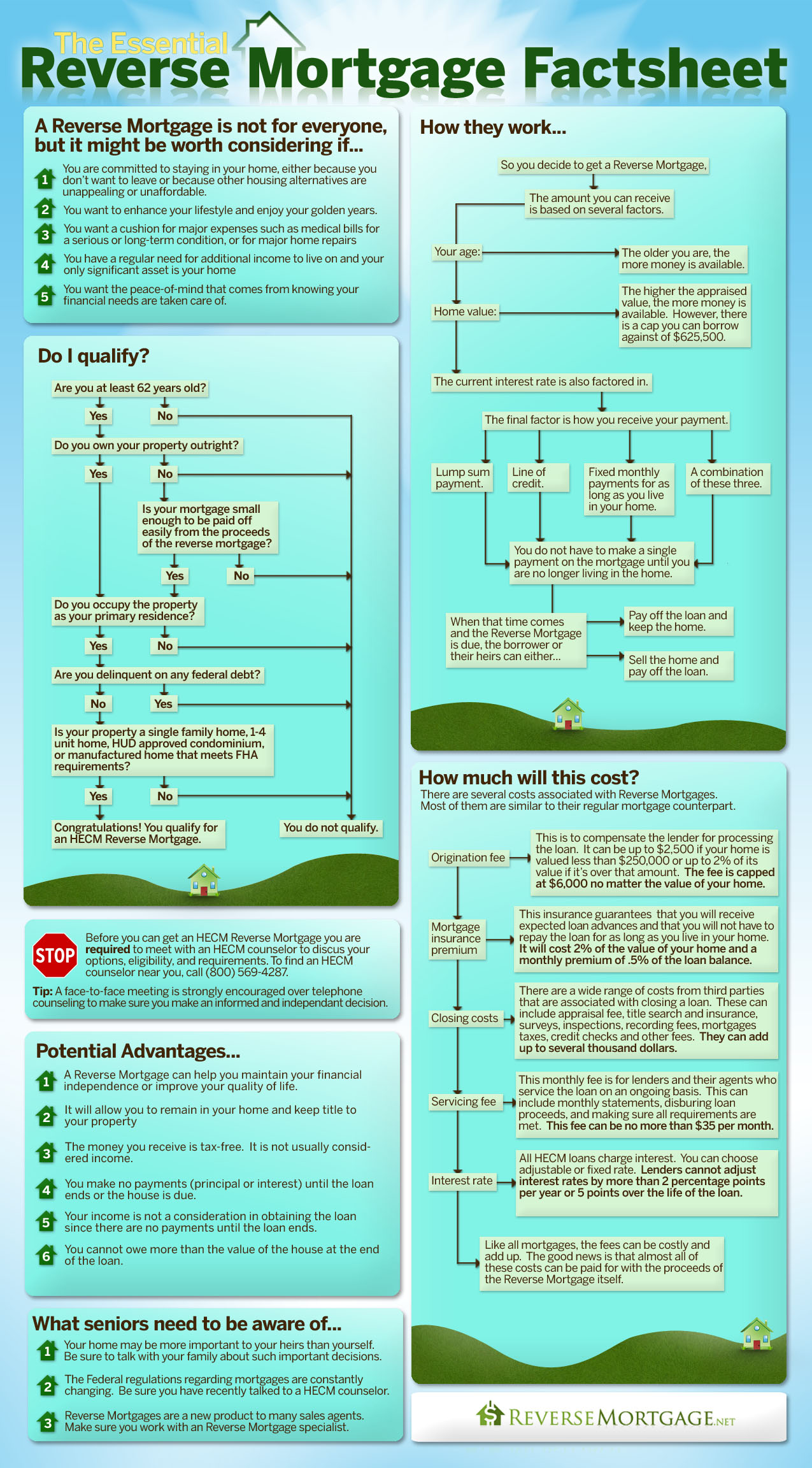

Why do genuine estate specialists need to understand about Reverse Home mortgages? Licensees are frequently the first point of contact when individuals begin to make real estate modifications. Having a fundamental understanding of the Reverse Mortgage product will assist licensees to better serve their clients and customers. As child boomers consider downsizing, upsizing, aging in place, or making any real estate transitions, all options can be presented. 1996 gotten used to enable 1-4 family houses, as long as 1 unit is owner inhabited. 2000-2005 saw minor modifications and follow up with debtors 2008 The Safe Act was established and Safeguards put in location for consumers, and guidelines for https://en.wikipedia.org/wiki/?search=reverse mortages counseling. 2009 The HECM (Home Equity Conversion Home loan) for purchase is introduced 2013 HUD put new HECM cops that make the product safe, stronger and less dangerous.

This is the very first time the HECM lending limitation has actually been raised given that President Barack Obama signed into law the American Recovery and Reinvestment Act in 2009. Reported by the FHA on December 1, 2016, it went into result on January 1, 2017 and will continue through December 31, 2017.

Home Morgages for Dummies

Home needs to fulfill FHA residential or commercial property standards and be a 1-4 household house or FHA approved condominium Advantages of Reverse Mortgages Capability to "age in place"- utilize house equity to maintain a more comfortable standard of living in the current home. Can be used to buy a brand-new primary home * without any mortgage payments.

Homeowner is accountable for paying real estate tax, homeowners insurance coverage and homeowner association dues, if relevant Safeguards/Consumer Protections Overseen by HUD (Real Estate & Urban Advancement) Guaranteed by FHA Potential borrowers should get counseling by a HUD approved Real estate Therapist before sending an application for reverse mortgage In MA, Counseling needs to be done Face to Face Counseling conducted by Independent 3rd party real estate therapy firm Counselors are HUD authorized, exam qualified, experts How Much Cash can be received.

The Main Principles Of Mortgages

Cost of Reverse Home mortgage Origination fee (max is $6000 and waived on a purchase) Home loan Insurance coverage cost (in advance range in between 2% of property https://www.washingtonpost.com/newssearch/?query=reverse mortages value and.05% of loan balance Conventional closing expenses: title, appraisal, flood certs Inspections Home and Bug may be required for existing building A state requirement A contract requirement An appraiser requirement An underwriter sees possible concern noted on the appraisal Study May be needed by a certified surveyor if: There is a discrepancy in the legal description Lot size or ingress/egress Well or septic remain in question Advancements are present The appraiser or underwriter calls for it Pay out options Swelling sum A withdrawal of your readily available benefit at loan closing, to pay off your existing home loan balance, if any, and to supply cash Repaired Month-to-month Payments Tenure: a fixed month-to-month payment for as long as you stay the home Term: a repaired monthly payment http://edition.cnn.com/search/?text=reverse mortages http://gunthersrak.over-blog.com/2019/12/10-signs-you-should-invest-in-home-mortgage-tax-deduction-2018.html for a specific term the customer picks Credit line A line of credit the customer can access at any time.

A combination of any of these alternatives. Differences in between a Home Equity Line of Credit and a Reverse Credit Line Greater versatility in payment. No regular monthly payments required UNLESS the customer dies, no longer lives n the property or fail to pay taxes and insurance & preserve the property HECM can be repaid at any time without charge.

The 5-Minute Rule for Home Morgages

Restricted earnings and property credentials Adjustable rate HECMs use a line of credit growth rate, so the unused portion increases over time. How a Reverse Mortgage can help your clients Prevent selling properties to keep cash Usage funds to acquire a vacation residential or commercial property without depleting significant amounts of properties. Receive tax-free proceeds to assist with day-to-day living expenditures.

The transaction involves the sale of an existing home, or the use of funds from other authorized methods, toward the purchase of a brand-new principal home. The HECM for Purchase financial resources the remaining balance. The brand-new house needs to be owner inhabited within 60 days of closing. At least 1 borrower needs to be 62 or older to certify Process & Protections Counseling (counseling certificate required) All customers need to be counseled by HUD authorized therapy agency.

Getting The Residential Mortages To Work

Certificate is excellent for 180 days. Fee varieties from $125-$250 per couple and undergoes change Counseling package includes financing assessment and information to receive the mandatory counseling. (HUD approved therapist) Prequalification is given Review of P&S before final signing Amendatory/Escape Provision signed with the contract Realty certification signed with the contract Application is processed Appraisal Evaluations Title Financing Closing No TRID, no Closing Disclosure.

The 4 NEVERS of Reverse Home Loan (Pros) The homeowner & his estate NEVER quit the title to the home The house owner, when leaving your house to his estate, can NEVER owe more than the houses worths. When your house is offered, proceeds in excess of the financial obligation belong to the house owner or his estate.

4 Simple Techniques For Mortgages

Regular monthly repayments are NEVER required or expected, although voluntary payments are accepted. Cautions to consider (Cons) There is less cash left to the beneficiaries. You are making the equity in your home liquid and therefore useable. When utilized, there is less available for successors. Residential or commercial property taxes and resident insurance need to be kept existing Property should be maintained and kept in excellent repair work Residential or commercial property must stay as your primary home, or the loan will become due.

Foreclosure The loan ends up being due and payable with the following maturity events: Non payment of residential or commercial property taxes Non payment of resident's insurance Not preserving the property in the condition it was purchased Vacating, selling or when the last customer dies. Effect of death of a partner If one spouse dies, absolutely nothing changes offered both were on the loan initially.

Reverse Mortgage for Beginners

2167 (2013) Massachusetts Regulations 209 CMR 55.00 Reverse Mortgage M.G.L.c 167E Section 7Aand M.G.L. c 171 Area 65C 1/2 SUGGESTED HANDOUTS: Retirement Trends and the Reverse Mortgage by David W. Johnson, Ph. D.; and Zamira S. Simkins, Ph. D. Reversing the Standard Knowledge by Barry and Stephen Sacks, J.D., Ph.

D The Government's Upgraded Reverse Mortgage Program by Alicia H. Munnell and Steven A. Sass The New Case for Reverse Home Mortgages by Wade Pfau, Ph. D., CFA.

A Biased View of Reverse Mortage Tips

A reverse mortgage runs in the opposite way of a standard home mortgage. With a traditional home loan, the homeowner pays the lender, reducing debt (the mortgage balance) and increasing equity (ownership) in the home with time. With a reverse home loan, the lender pays the property owner-- there are no monthly payments to the lending institution.

6 Online Communities About Reverse Mortage Tips You Should Join

The Best Guide To Residential Mortages

You'll likewise pay a yearly premium fee of 0.5 percent of your loan balance for HECM loans, although this expense can be financed into your loan. This does not consider other typical closing costs associated with any mortgage, such as file preparation, examinations, certifications, tape-recording fees, and the expense of credit reports as the lender will want to https://en.wikipedia.org/wiki/?search=reverse mortages examine your credit.

Nevertheless, reverse mortgages can also come due if you stop working to fulfill the regards to your arrangement, such as if you don't pay your real estate tax. The property owner inevitably has to keep up with the additional expenses of taxes, home insurance, and maintenance. Your total debt will be the amount of cash you take in money, plus the interest on the cash you borrowed.

Getting The Residential Mortages To Work

When your loan comes due, it must be paid back. Many reverse home mortgages are repaid through the sale of the house. For instance, the home will go on the marketplace after your death, and your estate will receive cash when it sells-- cash that must then be utilized to settle the loan.

You do not have to pay the difference with an HECM loan if you owe more than you offer your house for, and that's a good idea. A lot of reverse home loans include a clause that doesn't permit the loan balance to exceed the worth of the house's equity, although market changes can still result in less equity than when you took out the loan.

The 8-Second Trick For Mortgages

Your successors will have to create the money if they wish to keep your house in the family. It's possible that your estate might offer adequate other properties to allow them to do this, but otherwise, they may not have more info the ability to certify for a routine home mortgage to pay off the debt and keep the house.

Hospitalization of 12 months or less is OK if you require an extended stay in a long-term care center, but you 'd discover yourself in a position where you must repay the loan at a time when doing so might be impossible if you need to remain longer than that. A reverse home mortgage lender can foreclose and take your residential or commercial property if you fail to do so.

Not known Factual Statements About Mortgages

Be extremely sure that you can afford to keep up with your home's associated expenditures. Once again, foreclosure is possible if you can't stay up to date with these property taxes and insurance. Your lender may "set aside" a few of your loan proceeds to meet these costs if you can't. This is a plan you might willingly elect if you believe you'll ever have difficulty in this regard.

If and when your loan balance reaches the point where it exceeds your house's value, your loan provider may select foreclosure in this case too. On the other side, reverse home mortgages can provide cash for anything you desire, from supplemental retirement income to money for a big house improvement project.

The Best Guide To Reverse Mortage Tips

You 'd be decreasing your debt load in your retirement years if you take the cash and pay off your existing home loan. A reverse mortgage can definitely ease the stress of paying your costs in retirement ... or perhaps enhancing your lifestyle in your golden years. Initially, you need to satisfy some fundamental criteria: You can't be overdue on any debt owed to the federal government.

There's no loan-to-value calculation like you 'd have with a "forward" home mortgage. You'll have to prove to the loan provider that you're capable of staying up to date with the ongoing expenses of maintaining http://www.bbc.co.uk/search?q=reverse mortages your home. This makes sure that the property retains its worth and that you keep ownership of the property. You need to participate in counseling, a "consumer information session" with a HUD-approved counselor, before your HECM loan can be moneyed.

Residential Mortages - The Facts

Counselors work for independent organizations, so they need to offer unbiased details about the item. These courses are available at low cost and often they're even complimentary. You can still get a reverse home loan if you owe cash on your house-- you have a first home loan against it. Some individuals take a reverse home mortgage in order to eliminate the existing regular monthly payments by netting the loan income versus their existing home loan payment.

Amazon The fact is reverse home loans are exorbitantly expensive loans. Like a regular mortgage, you'll pay different charges and closing expenses that will amount to thousands of dollars. Additionally, you'll pay a home loan insurance coverage premium. With a routine home mortgage, you can prevent paying for mortgage insurance coverage if your deposit is 20% or more of the purchase rate.

The Only Guide to Home Morgages

The premium equates to 0.5% if you secure a loan equivalent to 60% or less of the appraised value of the home. The premium leaps to a tremendous 2.5% if the loan amounts to more than 60% of the home's worth. If your house is evaluated at $450,000 and you take out a $300,000 reverse home mortgage, it will cost you an additional $7,500 on top of all of the other closing costs.

The overall is charged based upon your life span. If you are anticipated to live another 10 years (120 months) you'll be charged another $3,600 to $4,200. That figure will be subtracted from the amount you receive. Most of the costs and costs can be rolled into the loan, which implies they compound gradually.

5 Simple Techniques For Home Morgages

Because you never ever pay down your reverse mortgage, the figure substances month after month. A routine home loan substances on a lower figure monthly. A reverse home mortgage compounds on a greater number. If you die, your estate pays back the loan with the profits from the sale of your house.

The other trigger for payment is that you move out of the home. As soon as you do, you have a year to close the loan. If you relocate to an assisted living home, you'll probably require the equity in your home to pay those expenses. In 2016, the typical expense of an assisted living home was $81,128 per year for a semi-private room.

The Ultimate Guide To Reverse Mortgage

In that case, unless your kids step up to pay for it, you're going to a Medicaid facility, which is something you most likely wish to prevent. The high expenses of reverse home loans are not worth it for the majority of people. You're better off offering your home and moving to a less expensive place, keeping whatever equity you have in your pocket instead of owing it to a reverse home loan lending institution.

Marc is Chief Income Strategist at the Oxford Club and Senior Citizen Editor of The Oxford Income Letter, where he runs the Immediate Income Portfolio, Substance Income Portfolio and Retirement Catch-Up/High Yield Portfolio. You can follow him on Twitter @stocksnboxing .

An Unbiased View of Mortgages

7th Sep 19, 9:26 https://www.washingtonpost.com/newssearch/?query=reverse mortages am Moneyhub's Christopher Walsh digs deep in to reverse home loans, what they are, their advantages, and their risks and downsides. This is a full resource if you are thinking about one Moneyhub's Christopher Walsh digs deep in to reverse home mortgages, what they are, their benefits, and their mistakes and drawbacks.

20 Reasons You Need To Stop Stressing About Mortgages

The Best Guide To Reverse Mortgage

For a HECM, the amount you can borrow will be based on the youngest borrower's age, the loan's rates of interest and the lower of your house's evaluated value or the FHA's optimum claim amount, which is $679,650 for 2018. You can't obtain 100% of what your house deserves, or anywhere close to it, however.

Here are a few other things you require to understand about how much you can obtain: The loan proceeds are based on the age of the youngest customer or, if the borrower is wed, the younger partner, even if the more youthful spouse is not a customer. The older the youngest borrower is, the higher the loan proceeds.

The greater your residential or commercial property's evaluated worth, the more you can borrow. A strong reverse mortgage financial assessment increases the earnings you'll receive because the lending institution won't withhold part of them to pay real estate tax and house owners insurance coverage in your place. The quantity you can really obtain is based upon what's called the preliminary primary limit.

Home Morgages - The Facts

The government decreased the preliminary primary limit in October 2017, making it harder for property owners, especially more youthful ones, to get approved for a reverse home loan. On the benefit, the change helps debtors protect more of their equity. The federal government lowered the limitation for the same factor it altered insurance premiums: because the home loan insurance fund's deficit had actually nearly folded the past .

To even more make complex things, you can't obtain all of your initial principal limitations in the very first year when you choose a swelling sum or a line of credit. https://www.washingtonpost.com/newssearch/?query=reverse mortages Rather, you can borrow as much as 60%, or more if you're utilizing the cash to pay off your forward mortgage. And if you pick a swelling sum, the amount you get up front is all you will ever get.

Both spouses have to consent to the loan, however both don't need to be debtors, and this arrangement can create issues. If 2 partners live together in a house but just one spouse is named as the customer on the reverse home loan, the other spouse is at threat of losing the home if the loaning partner dies initially.

10 Easy Facts About Mortgages Explained

If the making it through spouse wishes to keep the home, he or she will have http://edition.cnn.com/search/?text=reverse mortages to repay the loan through other methods, perhaps through a costly re-finance. Only one partner may be a customer if just one spouse holds title to your house, maybe due to the fact that it was acquired or since its ownership predates the marriage.

The nonborrowing spouse could even lose the home if the loaning partner had to move into a nursing home or retirement home for a year or longer. With a product as potentially profitable as a reverse mortgage and a vulnerable population of customers who might have cognitive disabilities or be frantically looking for monetary salvation, scams are plentiful.

The vendor or specialist may or may not actually provide on assured, quality work; they might simply steal the homeowner's cash. Loved ones, caregivers, and monetary advisors have actually also taken advantage of seniors by utilizing a power of attorney to reverse home loan the house, then stealing the proceeds, or by persuading them to purchase a financial item, such as an annuity or whole life insurance, that the senior can only manage by obtaining a reverse home mortgage.

The 2-Minute Rule for Residential Mortages

These are simply a few of the reverse mortgage rip-offs that can journey up unwitting property owners. Another risk connected with a reverse mortgage is the possibility of foreclosure. Despite the fact that the debtor isn't accountable for making any home loan payments-- and for that reason can't end up being delinquent on them-- a reverse mortgage needs the customer to meet particular conditions.

As a reverse home mortgage borrower, you are required to reside in the home and preserve it. If the house falls under disrepair, it will not be worth fair market price when it's time to sell, and the lending institution will not have the ability to recover the total it has extended to the customer.

Once again, the lender enforces these requirements to safeguard its interest in the home. If you don't pay your real estate tax, your local tax authority can seize your home. If you do not have house owners insurance and there's a house fire, the lending institution's security is damaged. About one in 5 reverse home mortgage foreclosures from 2009 through 2017 were brought on by the customer's failure to pay real estate tax or insurance, according to an analysis by Reverse Mortgage Insight.

Mortgages for Dummies

Ideally, anyone thinking about taking out a reverse mortgage will put in the time to thoroughly learn more about how these loans work. That way, no unethical loan provider or predatory scammer can prey on them, they'll be able to make a sound decision even if they get a poor-quality reverse home loan therapist and the loan will not include any undesirable surprises.

Customers need to make the effort to inform themselves about it to be sure they're making the very best choice about how to use their home equity.

Notes for the table illustrations Please note that these examples are for illustrative purposes only and give no guarantees as to any future equity that you might have in your home. Equity Staying is based on the estimated home value less loan balance consisting of interest. This figure does not permit for any costs that might be sustained throughout the sale of the residential or commercial property.

What Does Residential Mortages Mean?

and is subject to change. A rate of interest of % p.a. compounded monthly, consisting of appropriate costs or charges and no payments being made has actually been utilized in this example. Different rates of interest might apply. Various loan amounts, rates of interest, conditions, and fees and charges, will lead to different payment amounts.

This might imply that the amount of equity staying in your house (the distinction between the home's value and the impressive loan balance) may be significantly less http://driscollbarbaracorbinkuci.cavandoragh.org/enough-already-15-things-about-residential-mortages-we-re-tired-of-hearing at the end of the loan than it was at the beginning. However, Heartland Bank uses you the No Negative Equity Guarantee which implies that you will not need to pay us back more than the net sale proceeds of the residential or commercial property, even if this quantity is less https://en.search.wordpress.com/?src=organic&q=reverse mortages than the impressive loan balance.

A reverse mortgage is like a normal home loan that has actually Browse this site been developed for the needs of senior citizens. It allows individuals aged 60 and over to launch house equity to live a more comfortable retirement. Notably, you continue to own and reside in your house.

Little Known Questions About Reverse Mortgage.

If you require to free up a little cash as you head into retirement, a reverse mortgage could be the solution. A reverse mortgage lets you mortgage your home so you can access your equity with no repayments required up until you vacate. For many retirees, a reverse home loan uses monetary security to cover those unanticipated expenditures-- like house repair work or significant surgical treatment-- without needing to sell the family house.

How To Get More Results Out Of Your Residential Mortgages For Landlords

Getting The Reverse Mortage Tips To Work

Ask about "loan or grant programs for home repairs or enhancements," or "property tax deferral" or "real estate tax post ponement" programs, and how to use. Do you reside in a higher-valued home? You may be able to obtain more cash with an exclusive reverse home mortgage. But the more you borrow, the higher the costs you'll pay.

A HECM counselor or a loan provider can help you compare these kinds of loans side by side, to see what you'll get-- and what it costs. Compare costs and costs. This bears repeating: search and compare the expenses of the loans readily available to you. While the home mortgage insurance premium is typically the exact same from lender to lending institution, a lot of loan expenses-- consisting of origination fees, interest rates, closing costs, and maintenance costs-- vary amongst lenders.

Ask a counselor or lender to describe the Total Annual Loan Expense (TALC) rates: they show the forecasted yearly average expense of a reverse mortgage, https://en.search.wordpress.com/?src=organic&q=reverse mortages consisting of all the itemized expenses. And, no matter what kind of reverse mortgage you're thinking about, understand all the reasons why your loan might have to be paid back prior to you were preparing on it.

The Reverse Mortgage Ideas

A counselor from an independent government-approved housing counseling firm can assist. However a sales representative isn't likely to be the very best guide for what works for you. This is particularly real if she or he imitates a reverse mortgage is an option for all your problems, pushes you to take out a loan, or has ideas on how you can invest the cash from a reverse mortgage.

If you choose you need home enhancements, and you think a reverse mortgage is the way to spend for them, go shopping around prior to picking a particular seller. Your home enhancement expenses consist of not just the price of the work being done-- however likewise the costs and fees you'll pay to get the reverse home mortgage.

Resist that pressure. If you buy those type of monetary products, you could lose the cash you receive from your reverse mortgage. You do not need to buy any financial items, services or financial investment to get a reverse home loan. In reality, in some scenarios, it's prohibited to need you to buy other products to get a reverse mortgage.

Residential Mortages for Beginners

Stop and inspect with a counselor or someone you trust before you sign anything. A reverse home loan can be made complex, and isn't something to rush into. The bottom line: If you don't understand the expense or features of a reverse mortgage, leave. If you feel pressure or seriousness to complete the offer-- leave.

With a lot of reverse mortgages, you have at least 3 organisation days after near cancel the deal for any reason, without penalty. This is referred to as your right of "rescission." To cancel, you must notify the loan provider in composing. Send your letter by qualified mail, and ask for a return receipt.

Keep copies of your correspondence and any enclosures. After you cancel, the lending institution has 20 days to return any money you've spent for the financing. If you believe a rip-off, or that somebody involved in the transaction might be breaking the law, let the counselor, lending institution, or loan servicer understand.

Some Known Incorrect Statements About Reverse Mortage Tips

Whether a reverse mortgage is right reverse mortgage broker for you is a huge question. Consider all your choices. You may receive less pricey options. The following organizations have more information: U. S. Department of Housing and Urban Development (HUD) HECM Program 1-800-CALL-FHA (1-800-225-5342) Consumer Financial Protection Bureau Thinking About a Reverse Home Mortgage? 1-855- 411-CFPB (1-855-411-2372) AARP Foundation Reverse Mortgage Education Project 1-800-209-8085.

A reverse mortgage is a kind of loan that offers you with cash by Like a basic home mortgage, a reverse mortgage utilizes your The concept works comparable to a 2nd mortgage or house equity loan, however reverse home mortgages are only available to homeowners age 62 and older.

You need to normally license to the lending institution each year that you do certainly still live in the house. Otherwise, the loan will come due. Several sources for reverse home loans exist, however among the better alternatives is the Home Equity Conversion Home Loan (HECM) that's readily available through the Federal Real Estate Administration.

Get This Report about Reverse Mortgage

The amount http://edition.cnn.com/search/?text=reverse mortages of cash you'll receive from a reverse mortgage depends upon two major aspects. The more equity you have in your home, the more money you can get. For many borrowers, it's best if you have actually been paying for your loan over several years and your mortgage is practically entirely paid off.

Remember, however, that the actual rate and costs charged by your lending institution will probably vary from the presumptions used. You have a few alternatives, but the easiest is to take all the money at the same time in a swelling sum. Your loan has a fixed interest rate with this option, and your loan balance merely grows with time as interest accrues.

These payments are referred to as "tenure payments" when they Additional reading last for your whole life, or "term payments" when you receive them for a set amount of time, such as ten years. It's possible to take out more than you and your lending institution anticipated with life time payments if you live an incredibly long life.

Indicators on Residential Mortages You Need To Know

This enables you to draw funds if and when you need them. The advantage of a line of credit approach is that you just pay interest on the money you've really obtained, so your line of credit might potentially grow in time. You can utilize a mix of the programs above.

As with any other home loan, you'll pay interest and fees to get a reverse home mortgage. Focus on the costs and compare deals from a number of loan providers. Interest is intensified-- it's occasionally contributed to your loan balance, and interest is based on this increased loan balance the next time it's calculated.

It's absolutely worth looking around for the lowest-fee lending institution. Costs http://www.bbc.co.uk/search?q=reverse mortages are frequently funded, or built into your loan. To put it simply, you don't compose a check so you don't feel those costs, but you're still paying them, plus interest. Fees lower the quantity of equity left in your home, which leaves less for your estate or for you if you decide to sell the house and pay off the loan.

What Does Mortgages Do?

You'll pay a number of the same closing costs needed for a house purchase or re-finance, but these can be higher also. Most HECM costs can be included in your loan, nevertheless. A few of these expenses are beyond your control, however others can be managed and compared. You'll require an appraisal.

Origination costs differ from lender to loan provider, however your county tape-recording workplace charges the very same no matter who you use. You can plan on paying 2 percent of the first $200,000 of your home's value plus 1 percent of the worth over that, or a $2,500 flat fee, whichever corbinrs8l.jigsy.com/entries/general/17-signs-you-work-with-reverse-mortgage-lenders-new-zealand is greater, as much as a $6,000 cap on HECM loans.

Why You Should Focus On Improving Reverse Mortage Tips

Not known Details About Reverse Mortage Tips

They will likewise take a look at your monetary scenario more broadly to help you determine if a HECM is right for you. Constantly avoid any unsolicited deals for a reverse home mortgage or for assist with these loans. If you suspect you or your household have been targeted by a fraudster, call 800-347-3735 to file a grievance with HUD.

Reverse mortgages are extremely versatile. You can use the funds for a number of rewarding functions such as debt consolidation, living costs, home improvements, travel, medical expenses, aged care or acquiring a new vehicle. You can also pick to get your reverse mortgage amount as a lump amount, plus as routine advances, a cash reserve facility (similar to a 'line of credit'), or a combination of all 3.

Heartland just provides a variable rates of interest, permitting you Residential Mortages to make voluntary repayments. These can be made to your loan partially or in full at any time, without additional penalty charges, adding additional versatility and reducing the balance and interest charged. Once you move permanently from your home, the overall interest charged, together with the amounts drawn, will be payable.

U.S. Department of Housing and Urban Advancement|451 7th Street S.W., Washington, http://edition.cnn.com/search/?text=reverse mortages DC 20410 Telephone: (202) 708-1112 TTY: (202) 708-1455 Discover the address of the HUD office near you It's generally an opportunity for retired people to tap into the equity they've developed over numerous years of paying their mortgage and turn it into a loan on their own. A reverse home loan works like a routine mortgage in that you have to apply and get authorized for it by a lending institution.

9 Easy Facts About Reverse Mortgage Shown

However with a reverse home loan, you don't make payments on your home's principal like you would with a routine home loan-- you take payments from the equity you have actually constructed. You see, the bank is providing you back the cash you have actually currently paid on your house but charging you interest at the exact same time.

Seems easy enough, right? However http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/reverse mortages here comes the cringeworthy reality: If you die prior to you have actually sold your house, those you leave behind are stuck to 2 alternatives. They can either settle the full reverse home loan and all the interest that's piled up for many years, or surrender your home to the bank.

Like other types of home loans, there are various types of reverse home loans. While they all generally work the exact same method, there are 3 primary ones to understand about: The most common reverse home mortgage is the Home Equity Conversion Home Mortgage (HECM). HECMs were created in 1988 to help older Americans make ends satisfy by allowing them to use the equity of their houses without needing to leave.

Some folks will utilize it to pay for expenses, trips, home remodellings and even to pay off the staying quantity on their https://www.washingtonpost.com/newssearch/?query=reverse mortages routine mortgage-- which is nuts! And the effects can be big. HECM loans are kept on a tight leash by the Federal Real Estate Administration (FHA.) They do not want you to default on your home mortgage, so because of that, you won't get approved for a reverse mortgage if your home is worth more than a certain amount.1 And if you do qualify for an HECM, you'll pay a significant home mortgage insurance premium that protects the lending institution( not you)against any losses. They're provided from independently owned or operated companies.

Mortgages Can Be Fun For Anyone

And due to the fact that they're not regulated or guaranteed by the government, they can draw property owners in with guarantees of greater loan quantities-- but with the catch of much higher rates of interest than those federally guaranteed reverse home mortgages. They'll even offer reverse mortgages that permit house owners to borrow more of their equity or consist of houses that go beyond the federal optimum quantity. A single-purpose reverse mortgage is used by government firms at the state and local level, and by

nonprofit groups too. It's a type of reverse home mortgage that puts rules and restrictions on how you can use the cash from the loan.(So you can't invest it on a fancy holiday!) Normally, single-purpose reverse home mortgages can only be utilized to make property tax payments or spend for home repair work. The important things to bear in mind is that the lender has to authorize how the cash will be utilized prior to the loan is provided the OK. These loans aren't federally guaranteed either, so lending institutions don't need to charge home loan insurance premiums. However since the cash from a single-purpose reverse mortgage has actually to be used in a specific way, they're usually much smaller in their quantity than HECM loans or proprietary reverse mortgages. Own a paid-off (or at least considerably paid-down )home. Have this home as your main residence. Owe no federal financial obligations. Have the capital to continue paying real estate tax, HOA costs, insurance, upkeep and other home expenditures. And it's not simply you that has to certify-- your home likewise needs to satisfy particular requirements. The HECM program also permits reverse home loans on condos approved by the Department of Housing and Urban Development. Prior to you go and sign the papers on a reverse mortgage, check out these 4 major disadvantages: You may be thinking about taking out a reverse home mortgage due to the fact that you feel confident loaning versus your house. Let's simplify like this: Imagine having $100 in the bank, but when you go to withdraw that$100 in money, the bank just gives you$60-- and they charge you interest on that$60 from the$ 40 they keep. If you wouldn't take that"deal"from the bank, why in the world would you desire to do it with your house you've spent years paying a home mortgage on? However that's exactly what a reverse home mortgage does. Why? Due to the fact that there are costs to pay, which leads us to our next point. Reverse mortgages are packed with extra costs. And most customers choose to pay these costs with the loan they will get-- instead of paying them expense. The important things is, this expenses you more in the long run! Lenders can charge up to 2% of a house's value in an origination cost paid up front. So on a$200,000 house, that's a$ 1,000 yearly expense after you have actually paid $4,000 upfront of course! 4 Closing costs on a reverse home loan are like those for a regular home mortgage and include things like house appraisals

, credit checks and processing costs. So before you understand it, you've drawn out thousands from your reverse home mortgage prior to you even see the first dime! And because a reverse home loan is only letting you use a percentage the value of your house anyhow, what occurs once you Reverse Mortgage reach that limit? The cash stops.

No Time? No Money? No Problem! How You Can Get Residential Mortgages For Self Employed With A Zero-dollar Budget

The Buzz on Mortgages

This is the only choice that includes a fixed rate of interest. The other five have adjustable rates of interest. Equal monthly payments (annuity): For as long as at least one borrower lives in the house as a primary house, the lender will make steady payments to the customer. Term payments: The loan provider provides the borrower equal month-to-month payments for a set duration of the borrower's picking, such as ten years.

The It's likewise possible to utilize a reverse home loan called a "HECM for purchase" to buy a different house than the one you currently live in. In any case, you will usually need a minimum of 50% equity-- based on your home's current worth, not what you spent for it-- to certify for a reverse home loan.

The smart Trick of Reverse Mortage Tips That Nobody is Talking About

41,736 The number of reverse home loans provided in the U.S. in 2018, down 26.7% from the previous year. A reverse home loan may sound a lot like a home equity loan or line of credit. Certainly, similar to one of these loans, a reverse home mortgage can offer a swelling amount or a credit line that you can access as needed based upon just how much of your house you've settled and your house's market price.

A reverse home mortgage is the only method to gain https://en.search.wordpress.com/?src=organic&q=reverse mortages access to home equity without selling the house for seniors who don't desire the obligation of making a monthly loan payment or who can't get approved for a home equity loan or refinance since of minimal money circulation or poor credit. If you don't qualify for any of these loans, what choices stay for using house equity to fund your retirement!.?. !? You might offer and scale down, or you might offer your house to your kids or grandchildren to keep it in the family, maybe even becoming their renter if you want to continue residing in the house.

The smart Trick of Reverse Mortgage That Nobody is Talking About

A reverse mortgage allows you to keep residing in your home as long as you stay up to date with property taxes, maintenance, and insurance and do not need to move into an assisted living home or helped living center for more than a year. Nevertheless, securing a reverse home loan means spending a considerable quantity of the equity you have actually built up on interest and loan charges, which we will talk about below.

If a reverse home mortgage does not supply a long-term option to your monetary issues, just a short-term one, it might not be worth the sacrifice. What if another person, such as a friend, relative reverse mortgage attorney or roommate, copes with you? If you get a reverse home loan, that individual won't have any right to keep residing in the home after you die.

How Reverse Mortgage can Save You Time, Stress, and Money.

If you choose a payment strategy that does not supply a lifetime income, such as a lump amount or term strategy, or if you secure a credit line and utilize all of https://www.washingtonpost.com/newssearch/?query=reverse mortages it up, you may not have any money left when you require it. If you own a home, condo or townhouse, or a produced house developed on or after June 15, 1976, you might be qualified for a reverse home mortgage.

In New York, where co-ops prevail, state law even more prohibits reverse home loans in co-ops, enabling them only in one- to four-family residences and condominiums. While reverse home loans don't have earnings or credit report requirements, they still have guidelines about who certifies. You must be at least 62, and you need to either own your home totally free and clear or have a significant amount of equity (at least 50%).

The Facts About Reverse Mortgage Revealed

The federal government limits how much lending institutions can charge for these items. Lenders can't go after borrowers or their beneficiaries if the house ends up being underwater when it's time to offer. They likewise should permit any heirs a number http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/reverse mortages of months to decide whether they wish to repay the reverse home loan or allow the lender to offer the home to pay off the loan.

This therapy session, which normally costs around $125, must take at least 90 minutes and ought to cover the advantages and disadvantages of getting a reverse home loan given your distinct financial and individual scenarios. It ought to discuss how a reverse mortgage could affect your eligibility for Medicaid and Supplemental Security Income.

The Ultimate Guide To Mortgages

Your duties under the reverse home loan guidelines are to stay present on home taxes and homeowners insurance and keep the home in excellent repair work. And if you stop living in the home for longer than one year-- even if it's because you're residing in a long-lasting care facility for medical factors-- you'll have to repay the loan, which is usually achieved by offering the home.

Regardless of current reforms, there are still circumstances when a widow or widower might lose the house upon their partner's death. The Department of Real Estate and Urban Development changed the insurance premiums for reverse mortgages in October 2017. Considering that lending institutions can't ask property owners or their heirs to pay up if the loan balance grows larger than the home's value, the insurance coverage premiums supply a swimming pool of funds that lenders can draw on so they do not lose cash when this does occur.

Home Morgages Fundamentals Explained

The up-front premium used to be connected to how much borrowers got in the first year, with homeowners who secured the most-- due to the fact that they required to pay off an existing home loan-- paying the higher rate. Now, all borrowers pay the very same 2.0% rate. The up-front premium is determined based on the house's value, so for every $100,000 in appraised value, you Get more info pay $2,000.

All customers need to also pay annual mortgage insurance coverage premiums of 0.5% (formerly 1.25%) of the quantity obtained. This modification saves customers $750 a year for every single $100,000 obtained and helps balance out the greater up-front premium. It likewise means the customer's financial obligation grows more slowly, preserving more of the homeowner's equity gradually, supplying a source of funds later in life or increasing the possibility of having the ability to pass the house down to beneficiaries.

Facts About Residential Mortages Revealed

Reverse home mortgages are a specialty item, and just certain loan providers offer them. A few of the biggest names in reverse home loan financing consist of American Advisors Group, One Reverse Mortgage, and Liberty House Equity Solutions. It's an excellent concept to request a reverse home mortgage with a number of companies to see which has the most affordable rates and fees.

Only the lump-sum reverse mortgage, which provides you all the profits at once when your loan closes, has a set rates of interest. The other five alternatives have adjustable rates of interest, that makes sense, considering that you're borrowing cash over lots of years, not all at as soon as, and rate of interest are always changing.