Things about Financial Debt Solutions

An Unbiased View of Debt Management

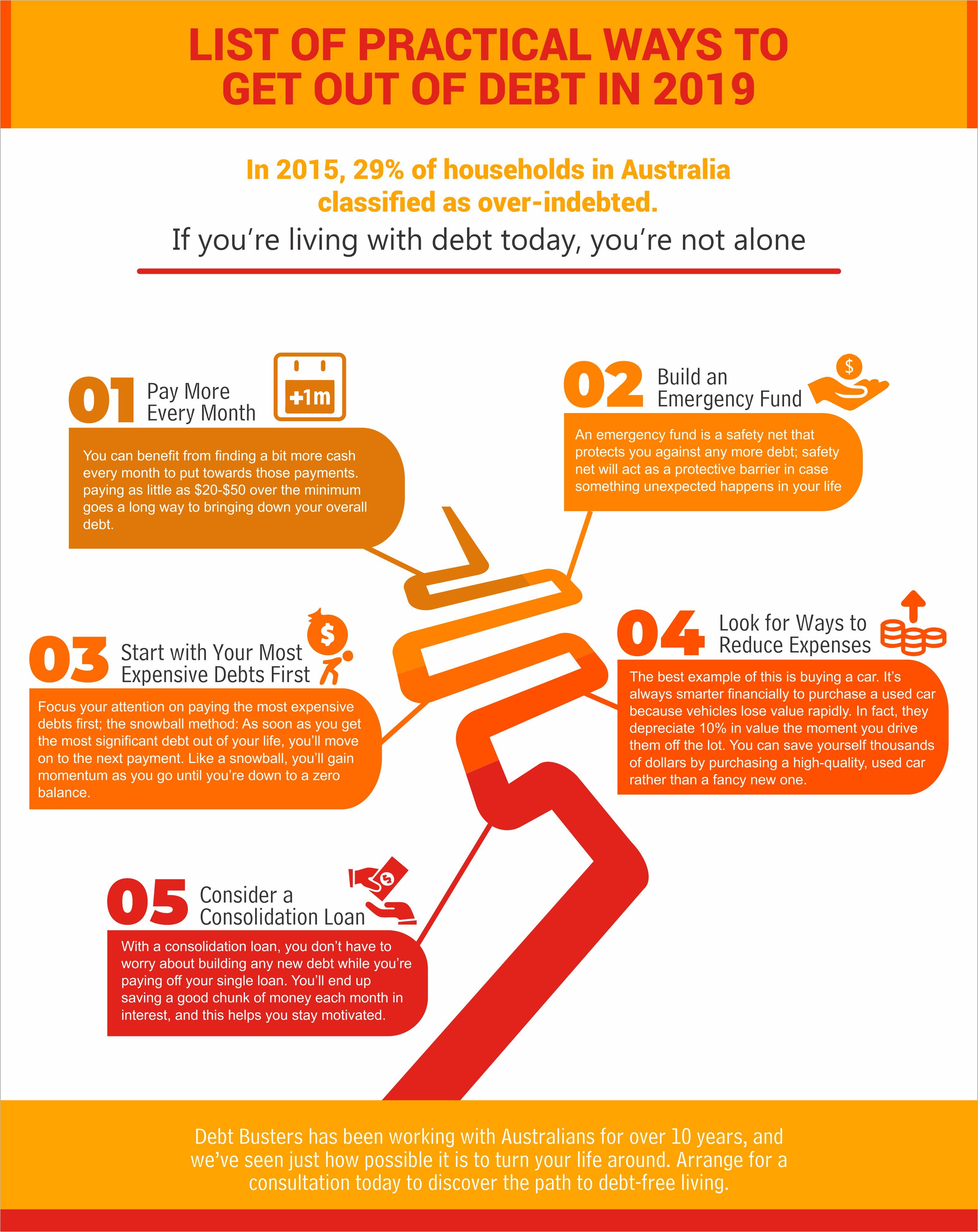

With the snowball technique, you 'd settle the tiniest debt, for Credit Card A, first, followed by Charge card C, Charge Card A, and then your vehicle loan. Technique No. 3: Settle costliest financial obligations initially. The snowball strategy may be more rewarding, as it lets you retire financial obligations as rapidly as possible, but it's not the most efficient.

It makes a lot of sense to pay that debt off initially, and then to take on Charge card C's debt, as it's the next-highest. The greater the rates of interest, the more money you'll be shelling out in interest, so it's very rational to retire your costliest debts first, leaving your lowest-interest rate financial obligations for last.

4: Consolidate financial obligations. Another choice is to consolidate all or many of your financial obligations, developing a big ball of debt. Why? Well, it can be easier to track that single big debt, rather of attempting to handle several financial obligations to numerous lending institutions. You probably can't roll every debt into one big debt, but you may be able to do so with all your credit card financial obligations, and it's possible to combine lots of trainee loans, as well.

You might get a personal or personal loan to pay off debts. Be sure to run the numbers first, however, ensuring you'll come out ahead. If you'll face a steep rate of interest or fees, it might not be worth it. You could use balance transfer cards, which we'll examine soon.

How Get Out Of Debt Fast can Save You Time, Stress, and Money.

You can get out of default. You can change to a lending institution you choose. Cons: You may wind up with a longer repayment duration, which implies you'll owe money longer (unless you can make additional payments) and will likely pay more in interest. You might lose some versatility, having just one huge debt instead of numerous smaller sized ones, with various terms.

5: Check out balance transfers. Remarkably, one technique to get out of charge card debt is to utilize ... charge card. Particularly, When searching for a balance-transfer card, try to find a generous grace duration, and fairly low standard rate of interest. Also think about the balance-transfer cost, if there is one. It's typical to be charged in between about 3% and 5% of the quantity you're transferring.

If you're uncertain that you'll be able to get your debt paid off throughout the grace period, consider going with a low-interest rate charge card rather-- but then do still try to pay off that debt as quickly as you can. Make sure to read the small print and detailed regards to any brand-new http://edition.cnn.com/search/?text=debt solutions charge card you're going to utilize.

Discover if you'll be charged any fees if you go beyond the limitation. And learn if there's a penalty APR, too. That's when the card company unexpectedly increases your rates of interest to 25% or even 30% if you pay an expense late or dedicate some other disobedience. Many cards don't feature them.

The smart Trick of Debt Management That Nobody is Discussing

6: Invest less and/or make more. This technique may appear obvious, but some people do not give it adequate consideration: Just investing less and/or earning more can leave you with a lot more cash that can be http://livinglowkey.com applied to debt decrease. Some might not be appealing, but you might have the ability to sustain them for Great post to read approximately a year or 2 to return into good monetary health and begin pursuing other objectives.

Work out lower charges from your cable television business. Cut the cable television cord and streaming your entertainment rather. Stop subscriptions such as gym subscriptions. Objective to spend less at dining establishments. Only purchase what's on your wish list. Don't go to malls and stores for home entertainment or out of dullness. Consume at restaurants less frequently.

Have pals over to play games, do puzzles, or view movies rather of going out. Delay non-critical major purchases, such as a brand-new large-screen TV or refrigerator. Shop with discount coupons in stores and discount coupon codes online. Trade babysitting services with buddies. Given up cigarette smoking. Here are some methods to make more cash : Take on a part-time task.

Think about operating at a local merchant or in your home, maybe tutoring trainees, teaching music, doing freelance writing or modifying, or consulting. If your home has 2 or more cars, consider whether you could offer one and manage for a while. Clear out mess in your basement, attic, and/or garage by selling items.

Unknown Facts About Get Out Of Debt Fast

Depending on where you live, you might be able to rent http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/debt solutions out space in your house via services such as Airbnb.com or VRBO.com. You may drive for a ride-sharing service such as Uber or Lyft. Or provide meals through services such as Grub Center or Door Dash. Be a dog-walker or pet-sitter.

Technique No. 7: Avoid dumb errors. A final strategy is merely to prevent dumb relocations that can set you back further. For instance, make certain to not sign up for a credit card with a "Do not presume you'll ultimately get out of debt Personal Debt by simply making minimum payments, either. That can be deadly.

Oops. Credit card debt and other high-interest rate financial obligations can be incapacitating, but here's fortunately: They don't have to be permanent. Yes, you might be feeling the problem of them now, but if you work hard at it for a year or 2, you may find yourself totally free of it and able to start constructing major net worth earlier than you expected. .

To get out of debt , you need a strategy and you require to carry out that strategy. To assist, the Credit.com team shares these 8 methods you can approach how to https://www.washingtonpost.com/newssearch/?query=debt solutions settle debt and leave some, if not all, of your financial burden behind: Keep this list where you can see-- like your fridge door or your vision board, if you have one, and make it a goal to inspect a job off the list frequently.

The 15-Second Trick For Debt Management

To begin to get out debt, start by knowing where you stand. You desire to have a total image. Here's what you require to get: Your latest bill statements for all charge card and loans, consisting of trainee loans. Your credit reports , so you can inspect for precision and identify all documented financial obligations.

Once you have your data in hand, make a list of all your debts, being sure to consist of: Financial institution's name Balance Minimum monthly payment Rate of interest Next, list just how much you require to pay in order to zero-out the debt's balance within three years or whatever your target timeframe is.

And know your regular monthly net earnings. This is the standard you need to deal with toward paying for those debts and buying groceries and such. The quantity will likewise offer you insight as to whether you need to benefit from Ways 4 and 5 below-- or just how much you require to consider methods 4 and 5.

The more you owe, the more interest you're charged and the more you owe. And round the cycle goes. If you find yourself with more charge card debt or debt from loans than you can handle, one method to at least start getting ahead of that debt is to pay less interest if possible.