Plain Advice On Trouble-Free Products Of Personal Debt

Excitement About Financial Debt Solutions

Investing is the act of utilizing money-- capital-- to make returns in the kind of interest, dividends, or through the gratitude of the investment item. Investing provides long-lasting advantages and making an income is the core of this undertaking. Investors can start with as little as $100, and accounts can even be set up for minors.

There are numerous products that you can invest in-- called financial investment securities . The most common financial investments remain in stocks, bonds, mutual funds, certificates of deposit (CDs), and exchange-traded funds. Each investment http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/debt solutions item carries a level of threat and this risk connects straight back to the level of earnings that a specific product provides.

Treasury debt are thought about the safest type of investing. These financial investments-- referred to as fixed-income financial investments-- supply constant income at a rate slightly higher than typical savings account from your bank. Security originates from the Federal Deposit Insurance Coverage Corporation (FDIC), the National Credit Union Administration (NCUA), and the strength of the U.S. federal government.

Stocks include large-cap, blue-chip companies such as Apple (AAPL), Bank of America (BAC), and Verizon (VZ). Many of these large, reputable companies pay a regular return on the invested dollar in the form of dividends. Stocks can also consist of small and startup business that hardly ever return income but can return a revenue in the gratitude of share worth.

A company will provide bonds with a set rates of interest and maturity date that financiers buy as they end up being the lender. The business will return regular interest payments to the financier and return the invested principal when the bond matures. Each bond will have credit ranking problems by ranking agencies.

Financial Debt Solutions Fundamentals Explained

Municipal bonds are debt released by neighborhoods throughout the United States. These bonds help build facilities such as sewer tasks, libraries, and airports. As soon as again, municipal bonds have a credit score based on the financial stability of the company. Mutual funds and ETFs are baskets of underlying securities that financiers can purchase shares or portions of.

Your danger tolerance is your capability how to get out of debt fast uk and desire to weather slumps in your financial investment choices. This threshold will assist you determine how risky a financial investment you should carry out. It can not be anticipated exactly, obviously, however you can get a rough sense of your tolerance for risk. Factors affecting your tolerance consist of the financier's age, earnings, time horizon till retirement or other milestones, and your specific tax circumstance.

They might have the ability to invest more strongly. If you are older, nearing or in retirement, or have pushing concerns, such as high healthcare expenses, you might choose to be more conservative-- less dangerous-- in your investment choices. Rather than time horizon you have until you quit working, the higher prospective payoff you could enjoy by investing rather than minimizing debt, since equities traditionally return 10% or more, pretax, in time.

Credit cards come in handy due to the fact that there is no need to bring cash. Nevertheless, lots of people can rapidly get in over their heads if they do not recognize just how much cash they invest in the card every month. However, not all debt is produced similarly. Keep in mind that some debt, such as your home loan, is okay.

You will need to pay this amount, however the tax advantage does reduce some of the hardship. When you borrow cash, the lending institution will charge a cost-- called interest -- on the money loaned. The rates of interest varies by loan providers, so, it is an excellent idea to shop around prior to you decide on where you borrow cash.

A Biased View of Get Out Of Debt

Your lender may utilize compound or basic interest to compute the interest due on your loan. Basic interest has a basis on only the principal amount borrowed. Substance interest included both the borrowed sum plus interest https://www.washingtonpost.com/newssearch/?query=debt solutions charges accumulated over the life of the loan. Also, there will be http://prosperopedia.com/how-to-get-out-of-debt/ a date by which the funds should be paid back to the lending institution-- understood as the payment date.

When paying for debt, there are numerous schools of thought on http://getpocketbook.com/blog/how-to-get-out-of-debt/ what to pay very first and how to go about paying it off. Again, a lender, account, or financial advisor can assist identify the best method for your scenario. Financial advisors suggest that working individuals have Learn more here at least six months' worth of regular monthly expenses in cash or a monitoring account.

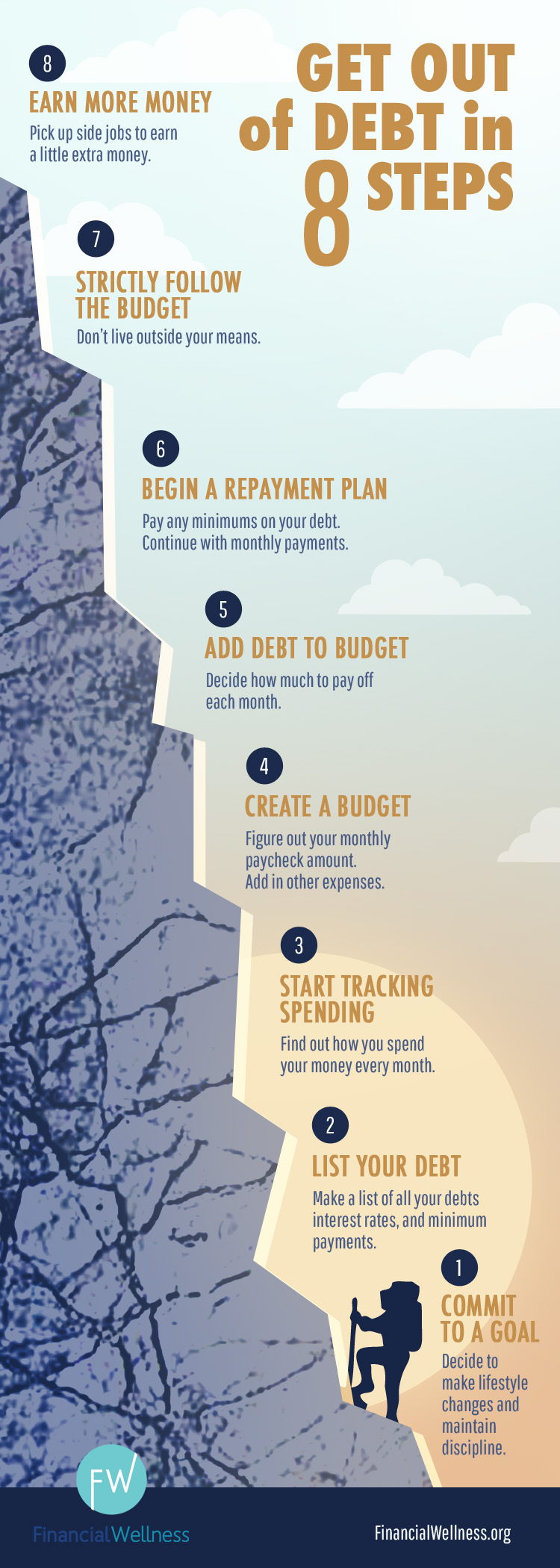

Advisors recommend that individuals keep a regular monthly debt-to-income ratio (DTI) of no greater than 25% to 33% of their pretax earnings. This ratio suggests that you need to invest no more than 25% to 33% of your earnings in paying off your debt. Paying off debt takes preparation and determination . A great first step is to take a major appearance at your regular monthly costs.

Identify how much you can save monthly and utilize this money-- even if it is only a few dollars-- to settle your debt. Paying for debt saves funds approaching paying interest that can then go to other uses. Develop a budget plan and plan how much you will need for living expenditures, transport, and food every month.

Prevent the temptation to fall back into bad costs routines. Dedicate yourself to sticking to your budget plan for a minimum of six months. Some advisors suggest settling the debt with the greatest interest initially. Still, other advisors suggest paying off the smallest debt initially. Whichever course you take, do your best to stick to it until the loan is paid.

9 Easy Facts About Personal Debt Explained

For example, the 50/30/20 spending plan reserve 20% of your income for savings and any debt payments above the minimum. This plan also designates 50% to important expenses-- real estate, food, utilities-- and the other 30% for personal expenditures. Financial advice author and radio host Dave Ramsey uses lots of The kind of debt or type of investment income can play a various function when it comes time to pay taxes.

Base your decision on an after-tax cost of obtaining versus an after-tax return on investing. As an example, assume you are a wage earner in the 35% tax bracket and have a traditional 30-year home loan with a 6% interest rate. Because you can subtract home mortgage interest -- within limitations-- from your federal taxes, your true after-tax cost of debt might be closer to 4%.

The Internal Revenue Service enables you to deduct the lesser of $2,500 or the amount you paid in interest on a qualified student loan used for college http://edition.cnn.com/search/?text=debt solutions expenses. Nevertheless, this reduction stages out at higher earnings levels. Earnings from interest paid from bonds, CDs and cost savings accounts Dividends paid from stocks-- also called equities The profit you make when you offer a holding that appreciated-- referred to as a capital gain Secret Takeaways Investing is the act of utilizing your cash to generate income.

Investment earnings can be found in the kind of interest, dividends, and asset gratitude. Debt is the loaning of money to finance a large or unforeseen event. Lenders charge either simple or compound interest on the loaned sums. Constructing a money cushion, creating a spending plan, and applying a determined method will help to pay off debt.