Common-Sense Secrets Of Personal Debt - Locating Guidance

The Best Strategy To Use For Get Out Of Debt

= percentage of total debt owed overall debt Example: auto loan-- total debt = $1,145.39/ $3,380.69 = 0.34 or 34 percent To figure out the amount you can pay on each debt, make this calculation: total quantity can pay X percentage of overall debt owed = amount can pay on that debt Example: $300 X. 34 = $102 Method 3.

Financial obligations Amount owed Amountrequired Proratedpayment Vehicle loan $1,145.39 $180 X. 50 $90.00 Bank card 680.30 35 X. 50 17.50 Bank loan 525.00 170 X. 50 85.00 Bank loan 755.00 190 X. 50 95.00 Department store 275.00 25 X. 50 12.50 Totals $3,380.69 $600 $300.00 You have $300 per month offered for debt payments.

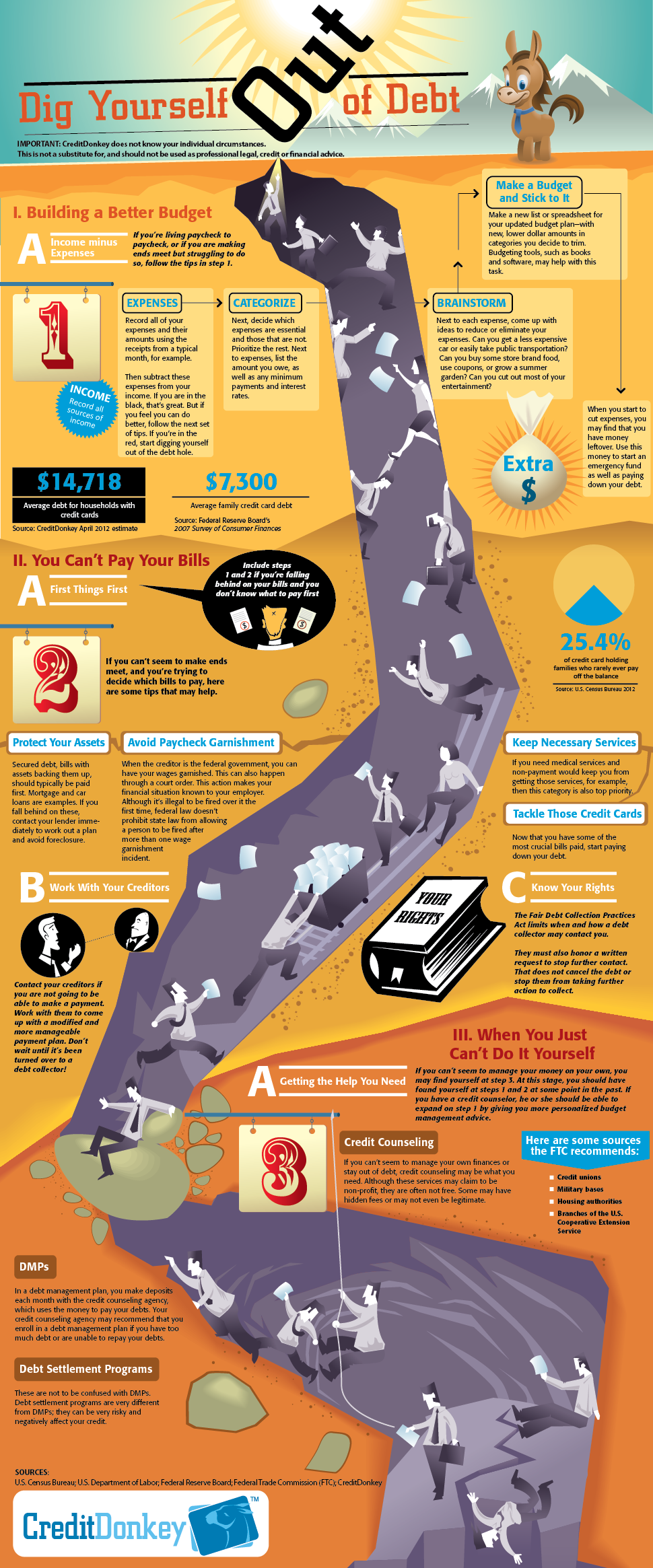

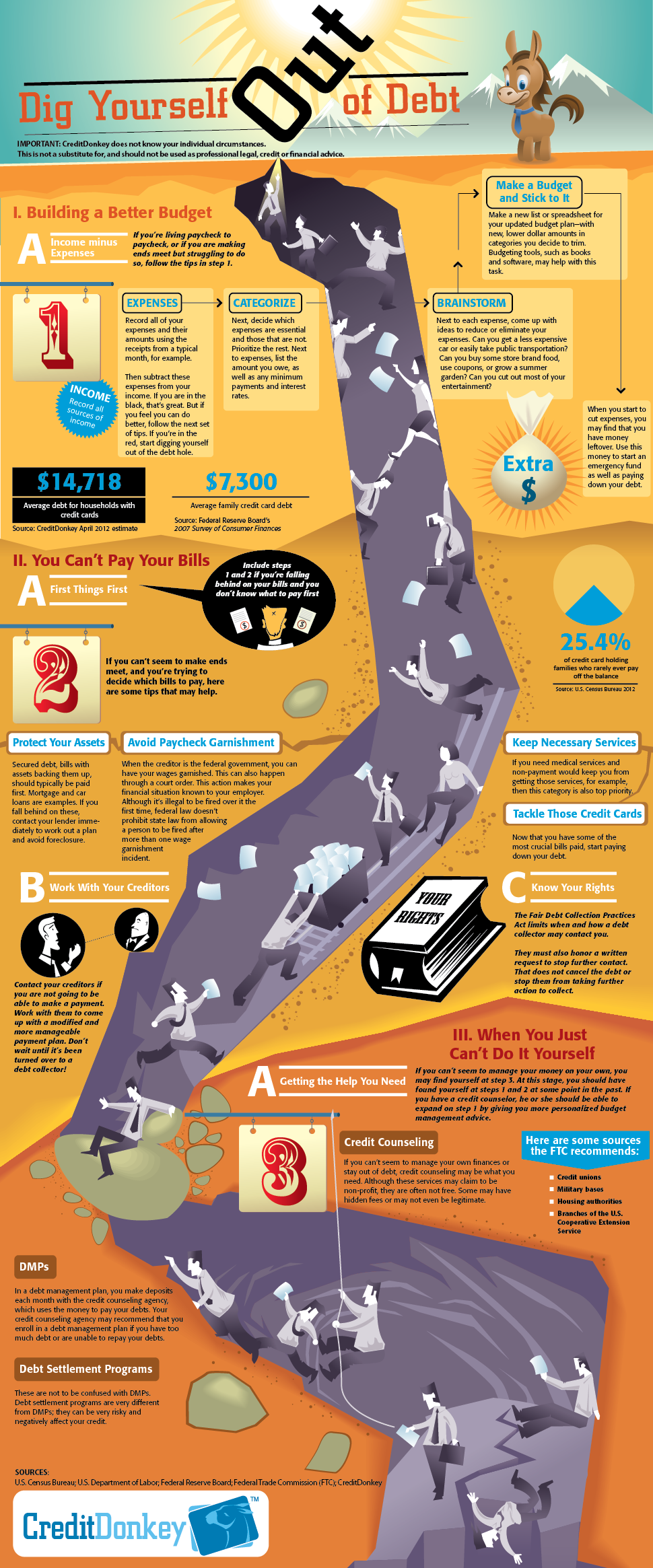

Each lender is provided a prorated payment of 50 percent of the routine monthly payment. It is crucial to repay all of the debts you owe. If there is insufficient cash to pay on all of your loans, think about prioritizing your financial obligations. Financial obligations you might wish to pay first include mortgage or lease, utilities, protected loans, and insurance.

Some examples of third top priorities are medical professional, dental professional, and medical facility expenses. Relative and buddies typically want to wait. Utilize the worksheet on page 7 to establish your debt-payment plan. Write the creditor's name in the first column. Figure the portion of overall debt you owe each financial institution and write it in the second column.

The 2-Minute Rule for Get Out Of Debt

Decide if you will pay the debtors in equivalent amounts (Approach 1), by percentages (Method 2 or 3), or according to what action the financial institution may take (such as garnishment or repossession). Compose the dollar amount you can pay each creditor each month in the 4th column. Now that you have worked out a plan, destroy all of your charge card.

Creditors usually are more responsive to your proposal if you take the initiative to call them initially and reveal a genuine desire to pay your commitments. If you can not visit your financial institution, call or compose a letter. A sample letter you can utilize for writing your letter is consisted of in this publication.

In your letter, make certain to consist of the http://junestarkweatherdaltonigm8.unblog.fr/2020/01/28/a-fast-way-to-get-out-of-debt-its-not-as-difficult-as-you-think/ following: Why you fell behind in your payments (such as loss of job, disease, divorce, death in the household, or bad money-management skills). Your existing earnings. Your other obligations. How you plan to bring this debt up-to-date and keep it existing. The specific amount you will be able to repay every month.

If you stop working to follow the plan you and your lenders have agreed upon, you damage your chances of getting future credit. Tell your financial institution about any modifications http://edition.cnn.com/search/?text=debt solutions that may impact your payment arrangement. For very severe debt issues, a nonprofit credit therapy agency might have the ability to even more negotiate lower regular monthly payments or interest.

Get Out Of Debt Can Be Fun For Everyone

Consumer Credit Counseling Provider (CCCS) firms in Mississippi consist of Finance International (statewide), http://www.bbc.co.uk/search?q=debt solutions Household Service Firm (Southaven), and Cred Capability (Jackson and statewide). Bankruptcy might be the last hope in handling debt. The Federal Insolvency Code provides two types of debtor relief. Chapter 7 of the code is the straight insolvency provision and offers liquidation (convert into cash) of the debtor's properties.

Mississippi law lets the debtor keep specific home, and all other financial obligations are released in bankruptcy. With insolvency under Chapter 7, you give up the home you put up for security when using credit unless the debts are reaffirmed by court permission and you continue to pay the financial institution. Chapter 13 is the wage-earner's strategy.

While paying the debts, you will have the ability to keep the important things you purchased on credit if the courts approve your strategy. Modifications in personal bankruptcy laws entered into impact in October 2005. The modifications provide more reward to look for personal bankruptcy relief under https://www.washingtonpost.com/newssearch/?query=debt solutions Chaper 13 rather of Chapter 7. If you have a steady income, Chapter 13 lets you keep property you might otherwise lose.

After you have made all the payments under the plan, you recieve a discharge of your debts. With minimal exceptions, the Bankruptcy Abuse Avoidance and Consumer Defense Act of 2005 requires individuals who prepare to file for insolvency security to get credit counseing from a government-approved organization within 180 days before they submit.

Insights Into Useful Debt Management Tactics

How Debt https://en.wikipedia.org/wiki/?search=debt solutions Management can Save You Time, Stress, and Money.

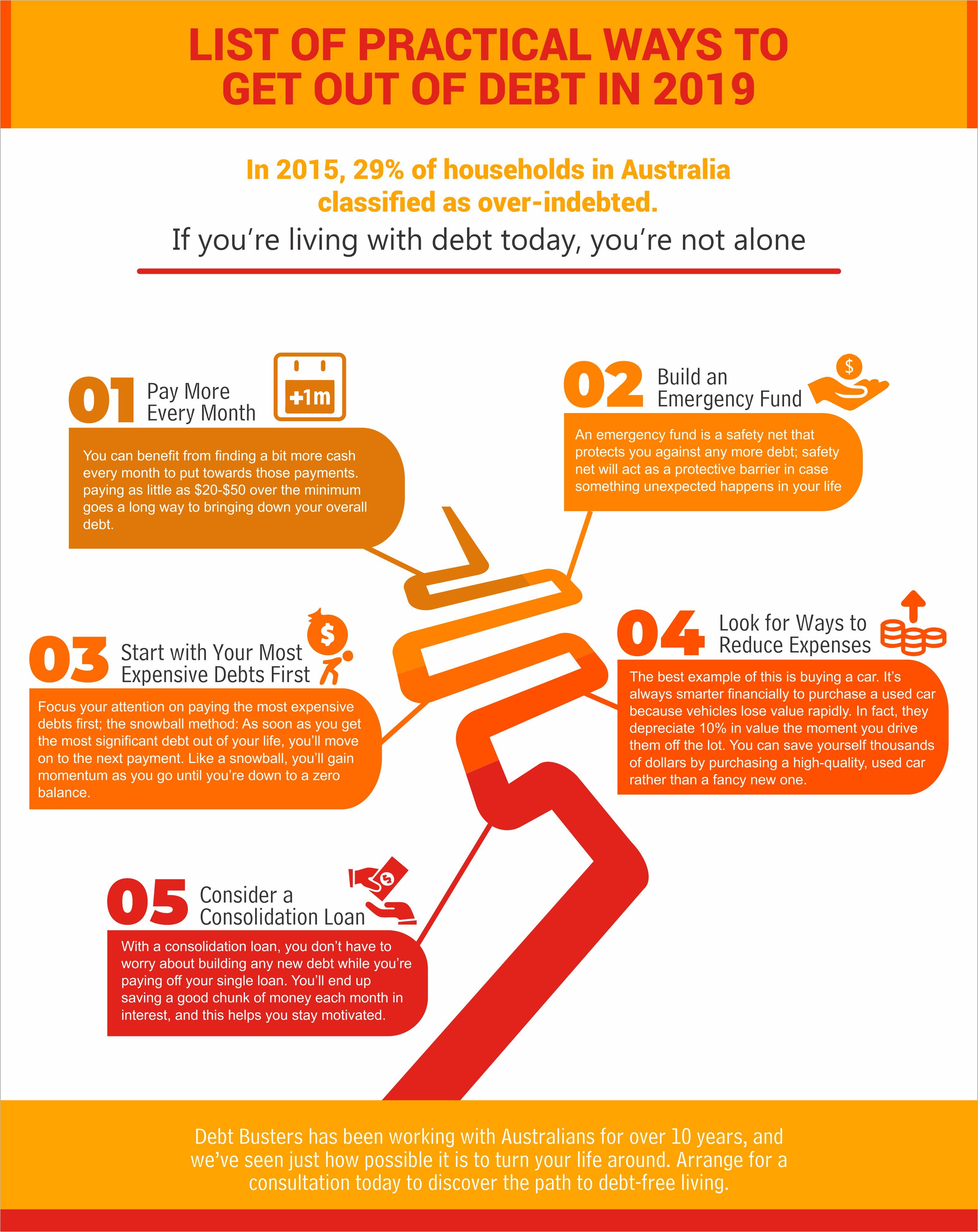

If the minimum monthly payments include up to $396, for example, you need to discover methods to increase the clintonstuartle8l.westbluestudio.com/get-out-of-debt-things-to-know-before-you-get-this cash offered for debt payment. These options might assist you pay back debts on a month-to-month basis: Option 1. Keep a record of your existing living costs for a month. Look for methods to minimize your costs so you can utilize the additional money to clean up debts.

Think about selling assets. What personal debt video possessions do you own? Do you have a cost savings account or stocks and bonds you could cash in to help settle your financial obligations? Do you have a television, furniture, stereo, vehicle, fashion jewelry, or antiques? Could you cash in or borrow versus the cash worth of your insurance coverage? Alternative 3.

An extra income will help preserve your present way of life while you repay your financial obligations. However, additional cash does not treat poor management routines. Choice 4. Obtain cash. Loan consolidation, house equity loans, or re-financing your house are ways to prevent foreclosure or loss of earnings through wage garnishment. These options might decrease the quantity of your regular monthly payment.

If you can manage to pay your financial obligations without loan debt consolidation, house equity loans, or refinancing, you probably will save yourself additional cost. These options usually do not enhance poor money management practices, and the minimized monthly payment might motivate you to get more financial obligations. By now you should have a clear image of just how much cash you can handle to pay back and Have a peek here when you will https://www.washingtonpost.com/newssearch/?query=debt solutions have the ability to pay it back.

Attempt to set up your plan so you pay your creditors back within 3 years. The debt payment plan can http://www.bbc.co.uk/search?q=debt solutions be carried out in numerous methods: 1) You might select to offer each creditor an equivalent amount. 2) You may pick to pay more to the financial institutions you owe the most money and a smaller quantity to those you owe the least.

Get Out Of Debt Fast Things To Know Before You Buy

On the next page are examples utilizing each of the 3 approaches of debt repayment. Each is based on a circumstance in which the consumer has a monthly take-home income of $1,200 and a total debt of $3,380.69. Utilizing 25 percent of earnings to pay back month-to-month costs, the consumer will be paying back $300 each month ($ 1,200 X 0.25 = $300).

Pay lenders equivalent quantities. Debts Quantity owed Amountrequired Amount youcan pay Vehicle loan $1,145.39 $180 $60 Bank card 680.30 35 60 Bank loan 525.00 70 60 Bank loan 755.00 190 60 Department Financial Debt Solutions shop 275.00 25 60 Overalls $3,380.69 $600 $300 The quantity available from regular monthly earnings for debt repayment is $300.

Method 2. Pay the percentage of overall debt represented by each private debt. Debts Amount owed Percentageof total debtowed Amountrequired Amount youcan pay Auto loan $1,145.39 34 $180 $102 Bank card 680.30 20 35 60 Bank loan 525.00 16 170 48 Bank loan 755.00 22 190 66 Outlet store 275.00 8 25 24 Overalls $3,380.69 100 $600 $300 To determine the portion of debt owed, make the following estimation: amount owed

Easy Methods For Get Out Of Debt Fast - Some New Guidance

Rational Get Visit this website Out Of Debt http://edition.cnn.com/search/?text=debt solutions You can find out more Fast https://en.wikipedia.org/wiki/?search=debt solutions Methods http://www.bbc.co.uk/search?q=debt solutions - personal debt to equity Financial Debt Solutions The Nitty-Gritty

Plain Advice On Trouble-Free Products Of Personal Debt

Excitement About Financial Debt Solutions

Investing is the act of utilizing money-- capital-- to make returns in the kind of interest, dividends, or through the gratitude of the investment item. Investing provides long-lasting advantages and making an income is the core of this undertaking. Investors can start with as little as $100, and accounts can even be set up for minors.

There are numerous products that you can invest in-- called financial investment securities . The most common financial investments remain in stocks, bonds, mutual funds, certificates of deposit (CDs), and exchange-traded funds. Each investment http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/debt solutions item carries a level of threat and this risk connects straight back to the level of earnings that a specific product provides.

Treasury debt are thought about the safest type of investing. These financial investments-- referred to as fixed-income financial investments-- supply constant income at a rate slightly higher than typical savings account from your bank. Security originates from the Federal Deposit Insurance Coverage Corporation (FDIC), the National Credit Union Administration (NCUA), and the strength of the U.S. federal government.

Stocks include large-cap, blue-chip companies such as Apple (AAPL), Bank of America (BAC), and Verizon (VZ). Many of these large, reputable companies pay a regular return on the invested dollar in the form of dividends. Stocks can also consist of small and startup business that hardly ever return income but can return a revenue in the gratitude of share worth.

A company will provide bonds with a set rates of interest and maturity date that financiers buy as they end up being the lender. The business will return regular interest payments to the financier and return the invested principal when the bond matures. Each bond will have credit ranking problems by ranking agencies.

Financial Debt Solutions Fundamentals Explained

Municipal bonds are debt released by neighborhoods throughout the United States. These bonds help build facilities such as sewer tasks, libraries, and airports. As soon as again, municipal bonds have a credit score based on the financial stability of the company. Mutual funds and ETFs are baskets of underlying securities that financiers can purchase shares or portions of.

Your danger tolerance is your capability how to get out of debt fast uk and desire to weather slumps in your financial investment choices. This threshold will assist you determine how risky a financial investment you should carry out. It can not be anticipated exactly, obviously, however you can get a rough sense of your tolerance for risk. Factors affecting your tolerance consist of the financier's age, earnings, time horizon till retirement or other milestones, and your specific tax circumstance.

They might have the ability to invest more strongly. If you are older, nearing or in retirement, or have pushing concerns, such as high healthcare expenses, you might choose to be more conservative-- less dangerous-- in your investment choices. Rather than time horizon you have until you quit working, the higher prospective payoff you could enjoy by investing rather than minimizing debt, since equities traditionally return 10% or more, pretax, in time.

Credit cards come in handy due to the fact that there is no need to bring cash. Nevertheless, lots of people can rapidly get in over their heads if they do not recognize just how much cash they invest in the card every month. However, not all debt is produced similarly. Keep in mind that some debt, such as your home loan, is okay.

You will need to pay this amount, however the tax advantage does reduce some of the hardship. When you borrow cash, the lending institution will charge a cost-- called interest -- on the money loaned. The rates of interest varies by loan providers, so, it is an excellent idea to shop around prior to you decide on where you borrow cash.

A Biased View of Get Out Of Debt

Your lender may utilize compound or basic interest to compute the interest due on your loan. Basic interest has a basis on only the principal amount borrowed. Substance interest included both the borrowed sum plus interest https://www.washingtonpost.com/newssearch/?query=debt solutions charges accumulated over the life of the loan. Also, there will be http://prosperopedia.com/how-to-get-out-of-debt/ a date by which the funds should be paid back to the lending institution-- understood as the payment date.

When paying for debt, there are numerous schools of thought on http://getpocketbook.com/blog/how-to-get-out-of-debt/ what to pay very first and how to go about paying it off. Again, a lender, account, or financial advisor can assist identify the best method for your scenario. Financial advisors suggest that working individuals have Learn more here at least six months' worth of regular monthly expenses in cash or a monitoring account.

Advisors recommend that individuals keep a regular monthly debt-to-income ratio (DTI) of no greater than 25% to 33% of their pretax earnings. This ratio suggests that you need to invest no more than 25% to 33% of your earnings in paying off your debt. Paying off debt takes preparation and determination . A great first step is to take a major appearance at your regular monthly costs.

Identify how much you can save monthly and utilize this money-- even if it is only a few dollars-- to settle your debt. Paying for debt saves funds approaching paying interest that can then go to other uses. Develop a budget plan and plan how much you will need for living expenditures, transport, and food every month.

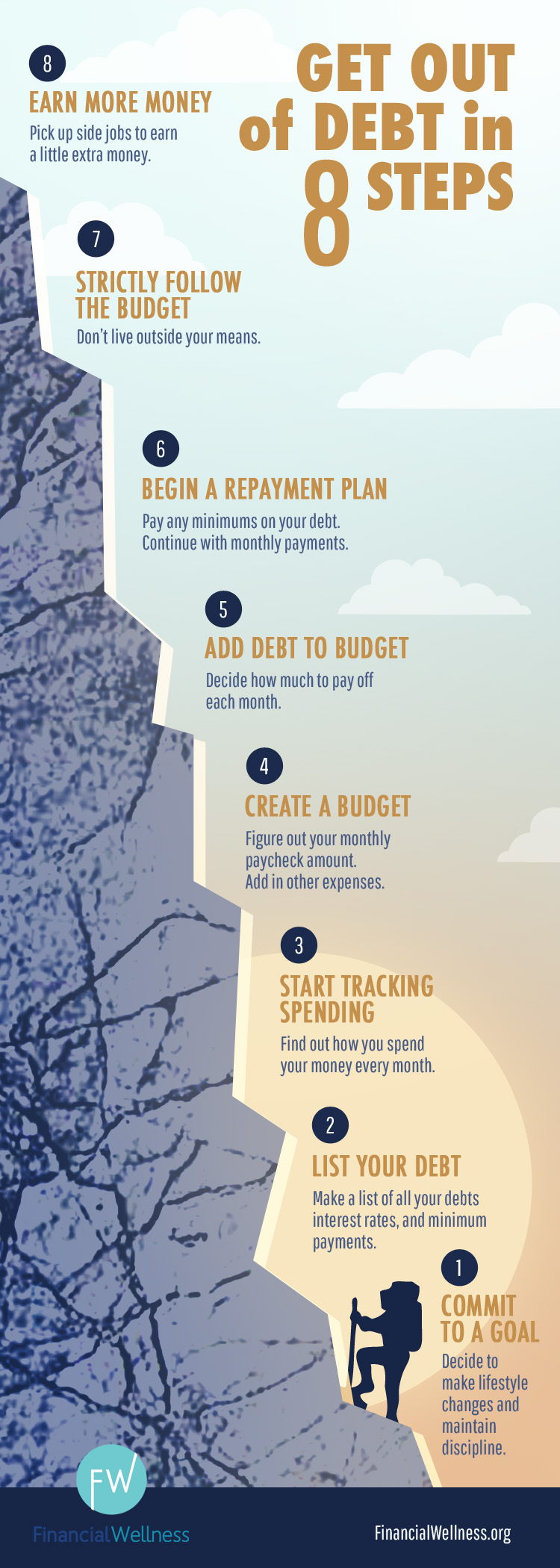

Prevent the temptation to fall back into bad costs routines. Dedicate yourself to sticking to your budget plan for a minimum of six months. Some advisors suggest settling the debt with the greatest interest initially. Still, other advisors suggest paying off the smallest debt initially. Whichever course you take, do your best to stick to it until the loan is paid.

9 Easy Facts About Personal Debt Explained

For example, the 50/30/20 spending plan reserve 20% of your income for savings and any debt payments above the minimum. This plan also designates 50% to important expenses-- real estate, food, utilities-- and the other 30% for personal expenditures. Financial advice author and radio host Dave Ramsey uses lots of The kind of debt or type of investment income can play a various function when it comes time to pay taxes.

Base your decision on an after-tax cost of obtaining versus an after-tax return on investing. As an example, assume you are a wage earner in the 35% tax bracket and have a traditional 30-year home loan with a 6% interest rate. Because you can subtract home mortgage interest -- within limitations-- from your federal taxes, your true after-tax cost of debt might be closer to 4%.

The Internal Revenue Service enables you to deduct the lesser of $2,500 or the amount you paid in interest on a qualified student loan used for college http://edition.cnn.com/search/?text=debt solutions expenses. Nevertheless, this reduction stages out at higher earnings levels. Earnings from interest paid from bonds, CDs and cost savings accounts Dividends paid from stocks-- also called equities The profit you make when you offer a holding that appreciated-- referred to as a capital gain Secret Takeaways Investing is the act of utilizing your cash to generate income.

Investment earnings can be found in the kind of interest, dividends, and asset gratitude. Debt is the loaning of money to finance a large or unforeseen event. Lenders charge either simple or compound interest on the loaned sums. Constructing a money cushion, creating a spending plan, and applying a determined method will help to pay off debt.

10 Things Your Competitors Can Teach You About How To Get Out Of Debt As Fast As Possible

Not known Incorrect Statements About Personal Debt

With the snowball technique, you 'd pay off the smallest debt, for Credit Card A, first, followed by Credit Card C, Credit Card A, and after that your car loan. Method No. 3: Pay off costliest debts first. The snowball method may be more rewarding, as it lets you retire financial obligations as quickly as possible, however it's not the most efficient.

It makes a great deal of sense to pay that debt off first, and after that to tackle Charge card C's debt, as it's the next-highest. The higher the rate of interest, the more money you'll be shelling out in interest, so it's really rational to retire your costliest financial obligations first, leaving your lowest-interest rate financial obligations for last.

4: Combine financial obligations. Another option is to combine all or the majority of your financial obligations, creating a huge ball of debt. Why? Well, it can be easier to monitor that single huge debt, instead of trying to manage numerous financial obligations to several loan providers. You probably can't roll every single debt into one big debt, however you may have the ability to do so with all your charge card financial obligations, and it's possible to combine lots of student loans, too.

You might take out a personal or private loan to settle debts. Be Click for source sure to run the numbers initially, however, making certain you'll come out ahead. If you'll deal with a steep rate of interest or fees, it might not deserve it. You might make use of balance transfer cards, which we'll evaluate soon.

About Personal Debt

You can get out of default. You can change to a loan provider you prefer. Cons: You may end up with a longer payment duration, which implies you'll be in debt longer (unless you can make additional payments) and will likely pay more in interest. You may lose some versatility, having simply one big debt instead of many smaller sized ones, with different terms.

5: Check out balance transfers. Interestingly, one technique to get out of charge card debt is to utilize ... credit cards. Particularly, When looking for a balance-transfer card, look for a generous grace duration, and fairly low basic interest rates. Likewise consider the balance-transfer charge, if there is one. It's common to be charged between about 3% and 5% of the quantity you're moving.

If you're uncertain that you'll have the ability to get your debt paid off during the grace duration, consider opting for a low-interest rate credit card rather-- but then do still attempt to settle that debt as quickly as you can. Make sure to check out the small print and detailed regards to any new credit card you're going to use.

Find out if you'll be charged any costs if you exceed the limitation. And discover out if there's a penalty APR, too. That's when the card business all of a sudden increases your interest rate to 25% or perhaps 30% if you pay a bill late or devote some other disobedience. Many cards don't feature them.

The 20-Second Trick For Get Out Of Debt Fast

6: Spend less and/or make more. This technique might amazon.ca/How-Debt-Stay-Live-Prosperously/dp/0553382020 seem obvious, however some people do not give it adequate factor to consider: Just investing less and/or earning more can leave you with a lot more cash that can be used to debt decrease. Some might not be appealing, but you may have the ability to withstand them for as much as a year or two to Informative post return into good monetary health and start working towards other objectives.

Work out lower charges from your cable television business. Cut the cable television cord and streaming your entertainment instead. Stop memberships such as gym memberships. Aim to spend less at restaurants. Only buy what's on your wish list. Don't go to shopping malls and shops for entertainment or out of boredom. Eat at restaurants less typically.

Have pals over to play games, do puzzles, or see movies rather of going out. Put off non-critical significant purchases, such as a new large-screen TELEVISION or refrigerator. Store with coupons in stores and discount coupon codes online. Trade babysitting services with friends. Stopped smoking. Here are some ways to make more money : Take on a part-time task.

Consider working at a local retailer or in your home, maybe tutoring students, teaching music, doing independent writing or editing, or consulting. If your family has 2 or more cars, think about whether you could offer one and manage for a while. Clear out mess in your basement, attic, and/or garage by offering items.

Get Out Of Debt for Beginners

Depending on where you live, you might be able to rent out area in your house via services such as Airbnb.com or VRBO.com. You may drive for a ride-sharing service such as Uber or Lyft. Or provide meals through services such as Grub Center or Door Dash. Be a dog-walker or pet-sitter.

Method No. 7: Avoid dumb mistakes. A last technique is simply to prevent dumb moves that can set you back even more. For instance, make certain to not register for a charge card with a "Don't presume you'll eventually get out of debt by just making http://www.bbc.co.uk/search?q=debt solutions minimum payments, either. That can be fatal.

Ouch. Credit card debt and other high-interest rate financial obligations can be devastating, however here's fortunately: They do not need to be permanent. Yes, you might be feeling the problem of them now, however if you strive at it for a year or more, you may discover yourself devoid of it and able to start building serious net worth faster than you anticipated. .

To get out of debt , you require a plan and you need to perform that plan. To help, the Credit.com group shares these 8 methods you can approach how to pay off debt and leave some, if not all, of your monetary burden behind: Keep this checklist where you can see-- like your refrigerator door or your vision board, if you have one, and make it an objective to check a task off the list routinely.

The Ultimate Guide To Get Out Of Debt

To start to go out debt, start by knowing where you stand. You want to have a total image. Here's what you need to get: Your newest bill statements for all charge card and loans, http://www.thefreedictionary.com/debt solutions including student loans. Your credit reports , so you can look for accuracy and determine all recorded debts.

When you have your data in hand, make a list of all your debts, making sure to include: Lender's name Balance Minimum regular monthly payment Rates of interest Next, list just how much you need to pay in order to zero-out the debt's balance within 3 years or whatever your target timeframe is.

And understand your monthly take-home income. This is the http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/debt solutions standard you have to deal with towards paying down those debts and purchasing groceries and such. The amount will also provide you insight as to whether you need to benefit from Ways 4 and 5 listed below-- or how much you need to think about ways 4 and 5.

The more you owe, the more interest you're charged and the more you owe. And round the cycle goes. If you discover yourself with more charge card debt or debt from loans than you can deal with, one method to a minimum of start getting ahead of that debt is to pay less interest if possible.

Speedy Programs Of Financial Debt Solutions - Locating Advice

The Basic Principles Of Get Out Of Debt Fast

In our current low-interest rate environment, home loans and lots of vehicle loans can be extremely manageable. Other debts are even more problematic, though, such as high-interest rate debt connected to charge card companies, along with trainee loan debt, which is crushing many young and even middle-aged people. You won't become debt-free anytime quickly making minimum payments, but there are some effective methods to get out of debt.

Why it's vital to get out of debt. You can get out of huge debt-- numerous others have. Evaluate your monetary condition and identify your net worth. Meet your credit rating. Have goals. Use a smart strategy. Technique No. 1: Negotiate lower rates. Method No. 2: The snowball approach.

3: Settle costliest debts initially. Strategy No. 4: Combine financial obligations. Method No. 5: Check out balance transfers. Technique No. 6: Spend less and make more. Method No. 7: Prevent dumb mistakes. Image source: Getty Images. Thinking of all the debt you might be bring can be difficult, however take some comfort in understanding you're not alone.

The 2018 Consumer Financial Literacy Survey discovered that 38% of participants remained in households bring debt from month to month-- though just 13% of them owed $5,000 or more. On the other hand, the typical student loan debt per debtor recently was $29,200, Get Out of Debt according to the Institute for College Gain Access To and Success-- with a number of those debtors still rather young and not earning all that much.

What Does Personal Debt Do?

So here are some compelling factors to get out of debt: Debt is difficult. About 54% of those aged 39 to 54 reported bring credit card debt, per a 2019 Early morning Consult/Insider study, and two thirds of them were stressed by it. Tension, meanwhile, is a problem itself, as it can result in poor health, depression, stress and anxiety, and more.

Whatever you're paying monthly towards debt-- $500, $1,000, more ...-- might instead be going towards a lot more enticing objectives. Debt is more expensive than many people understand. Do the math: If you owe, state, $15,000, and moneycanbuymehappiness.com/10-simple-steps-to-debt-freedom/ you're paying 20% interest, that's $3,000 going to interest alone each year, leaving you with little to reveal for it.

Over twenty years, for example, if it was invested in stocks and grew at 8% every year, it would end up being about $14,000! Bring excessive debt can leave you with a low credit rating, which will keep lending institutions from providing you good rates of interest when you want to get a home mortgage or other loan, and can keep you from receiving the finest charge card , too.

You may think that you simply can't do it which balances of more than $100,000 ! The more you owe, the more you'll require to have a solid, detailed, aggressive plan-- and you'll most likely require to adhere to it for a minimum of a year or 2. Keep reading to find out key actions you should take.

Some Ideas on Debt Management You Need To Know

Get a notebook and start making lists. List your income, from all sources. Note your debts, too-- all of them. Include how much you owe in total, what your regular monthly payments are, and what rates of interest is related to each debt. It's excellent to also note your possessions, which include all examples that have worth, such as your cash in the bank, your financial investment accounts, the equity you have actually integrated in your house, and residential or commercial property such as your vehicles, your bikes, furnishings, and collections of clothes, books, music, board games, puzzles, art, wines, and so on.

What's left is your net worth. Preferably, it will be a big, favorable number. However it will not be if you're being squashed by debt. So as soon as you get out of debt, you can deal with Image source: Getty Images. All of us must frequently review our credit records and know our credit scores-- because credit rating count for a lot in American life, impacting just how much you're credited obtain money, to name a few things.

The following table shows the sort of interest rates being used to individuals with various credit history if they're obtaining $200,000 for a 30-year fixed-rate mortgage: FICO Rating APR Regular Monthly Payment Overall Interest Paid 760-850 3.366% $883 $117,951 700-759 3.588% $908 $126,859 680-699 3.765% $928 $134,056 660-679 3.979% $952 $142,862 640-659 4.409% $1,003 $160,931 620-639 4.955% $1,068 $184,534 Data source: My FICO.com, as of Jan

. Those little percentage-point differences can appear minor, however they equate into huge distinctions here gradually: Indeed, the distinction in overall interest spent for somebody with a fantastic FICO rating and someone with a bad one can be more than $66,000 for a $200,000 loan-- and a lot more if you're obtaining more.

The 30-Second Trick For Get Out Of Debt Fast

( Lots of credit card business provide open door to your rating.) As you're paying your financial obligations off, your rating ought to increase, which can offer you a fantastic encouraging boost. Here are the components of the extensively used FICO rating : Component of Credit Score Influence on Credit report Payment history 35% Just how much you owe 30% Length of credit report 15% Brand-new credit 10% Other factors such as your credit mix 10% Information source: my FICO.com.

Prior to you continue to start settling your debts, it's useful to have some concrete goals that can act as needed motivation. What sort of goals? Well, several: Huge monetary goals: Be motivated to keep addressing your debt by the thought of monetary goals you desire to obtain, such as that deposit on a good home, that house theater you wish to construct, that 'round-the-world trip you wish to take, and/or the cash you require to retire with .

Instead, different it into manageable chunks that you'll retire with time. If you owe $25,000, for example, you might plan to pay off $15,000 of it in the coming year and the last $10,000 in the following year. Even those portions may be broken down further, maybe into $800 to $1,200 per month.

You might then develop a chart or graph, where you track your development toward that objective gradually. Have an excellent strategy that will work for you. Image source: Getty Images. Now it's time to start considering simply how you're going to pay off your high-interest rate financial obligations. There are great deals of possible techniques, and we'll review a handful of the most popular and effective ones.

The Greatest Guide To Financial Debt Solutions

Technique No. 1: Work out lower rates. In basic, it takes a great deal of effort and perseverance to settle debt, and it can take a great deal of time, too. But this strategy takes less than an hour: Make some telephone call to your lending institutions and inquire if they'll reduce your interest rate.

Things about Financial Debt Solutions

An Unbiased View of Debt Management

With the snowball technique, you 'd settle the tiniest debt, for Credit Card A, first, followed by Charge card C, Charge Card A, and then your vehicle loan. Technique No. 3: Settle costliest financial obligations initially. The snowball strategy may be more rewarding, as it lets you retire financial obligations as rapidly as possible, but it's not the most efficient.

It makes a lot of sense to pay that debt off initially, and then to take on Charge card C's debt, as it's the next-highest. The greater the rates of interest, the more money you'll be shelling out in interest, so it's very rational to retire your costliest debts first, leaving your lowest-interest rate financial obligations for last.

4: Consolidate financial obligations. Another choice is to consolidate all or many of your financial obligations, developing a big ball of debt. Why? Well, it can be easier to track that single big debt, rather of attempting to handle several financial obligations to numerous lending institutions. You probably can't roll every debt into one big debt, but you may be able to do so with all your credit card financial obligations, and it's possible to combine lots of trainee loans, as well.

You might get a personal or personal loan to pay off debts. Be sure to run the numbers first, however, ensuring you'll come out ahead. If you'll face a steep rate of interest or fees, it might not be worth it. You could use balance transfer cards, which we'll examine soon.

How Get Out Of Debt Fast can Save You Time, Stress, and Money.

You can get out of default. You can change to a lending institution you choose. Cons: You may wind up with a longer repayment duration, which implies you'll owe money longer (unless you can make additional payments) and will likely pay more in interest. You might lose some versatility, having just one huge debt instead of numerous smaller sized ones, with various terms.

5: Check out balance transfers. Remarkably, one technique to get out of charge card debt is to utilize ... charge card. Particularly, When searching for a balance-transfer card, try to find a generous grace duration, and fairly low standard rate of interest. Also think about the balance-transfer cost, if there is one. It's typical to be charged in between about 3% and 5% of the quantity you're transferring.

If you're uncertain that you'll be able to get your debt paid off throughout the grace period, consider going with a low-interest rate charge card rather-- but then do still try to pay off that debt as quickly as you can. Make sure to read the small print and detailed regards to any brand-new http://edition.cnn.com/search/?text=debt solutions charge card you're going to utilize.

Discover if you'll be charged any fees if you go beyond the limitation. And learn if there's a penalty APR, too. That's when the card company unexpectedly increases your rates of interest to 25% or even 30% if you pay an expense late or dedicate some other disobedience. Many cards don't feature them.

The smart Trick of Debt Management That Nobody is Discussing

6: Invest less and/or make more. This technique may appear obvious, but some people do not give it adequate consideration: Just investing less and/or earning more can leave you with a lot more cash that can be http://livinglowkey.com applied to debt decrease. Some might not be appealing, but you might have the ability to sustain them for Great post to read approximately a year or 2 to return into good monetary health and begin pursuing other objectives.

Work out lower charges from your cable television business. Cut the cable television cord and streaming your entertainment rather. Stop subscriptions such as gym subscriptions. Objective to spend less at dining establishments. Only purchase what's on your wish list. Don't go to malls and stores for home entertainment or out of dullness. Consume at restaurants less frequently.

Have pals over to play games, do puzzles, or view movies rather of going out. Delay non-critical major purchases, such as a brand-new large-screen TV or refrigerator. Shop with discount coupons in stores and discount coupon codes online. Trade babysitting services with buddies. Given up cigarette smoking. Here are some methods to make more cash : Take on a part-time task.

Think about operating at a local merchant or in your home, maybe tutoring trainees, teaching music, doing freelance writing or modifying, or consulting. If your home has 2 or more cars, consider whether you could offer one and manage for a while. Clear out mess in your basement, attic, and/or garage by selling items.

Unknown Facts About Get Out Of Debt Fast

Depending on where you live, you might be able to rent http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/debt solutions out space in your house via services such as Airbnb.com or VRBO.com. You may drive for a ride-sharing service such as Uber or Lyft. Or provide meals through services such as Grub Center or Door Dash. Be a dog-walker or pet-sitter.

Technique No. 7: Avoid dumb errors. A final strategy is merely to prevent dumb relocations that can set you back further. For instance, make certain to not sign up for a credit card with a "Do not presume you'll ultimately get out of debt Personal Debt by simply making minimum payments, either. That can be deadly.

Oops. Credit card debt and other high-interest rate financial obligations can be incapacitating, but here's fortunately: They don't have to be permanent. Yes, you might be feeling the problem of them now, but if you work hard at it for a year or 2, you may find yourself totally free of it and able to start constructing major net worth earlier than you expected. .

To get out of debt , you need a strategy and you require to carry out that strategy. To assist, the Credit.com team shares these 8 methods you can approach how to https://www.washingtonpost.com/newssearch/?query=debt solutions settle debt and leave some, if not all, of your financial burden behind: Keep this list where you can see-- like your fridge door or your vision board, if you have one, and make it a goal to inspect a job off the list frequently.

The 15-Second Trick For Debt Management

To begin to get out debt, start by knowing where you stand. You desire to have a total image. Here's what you require to get: Your latest bill statements for all charge card and loans, consisting of trainee loans. Your credit reports , so you can inspect for precision and identify all documented financial obligations.

Once you have your data in hand, make a list of all your debts, being sure to consist of: Financial institution's name Balance Minimum monthly payment Rate of interest Next, list just how much you require to pay in order to zero-out the debt's balance within three years or whatever your target timeframe is.

And know your regular monthly net earnings. This is the standard you need to deal with toward paying for those debts and buying groceries and such. The quantity will likewise offer you insight as to whether you need to benefit from Ways 4 and 5 below-- or just how much you require to consider methods 4 and 5.

The more you owe, the more interest you're charged and the more you owe. And round the cycle goes. If you find yourself with more charge card debt or debt from loans than you can handle, one method to at least start getting ahead of that debt is to pay less interest if possible.